David Rathgeber's

Miscellanea

Go to...

Click here for timely topics in real estate.

Trading Guidelines for Investors - March 2024

General Guidelines for Investors - February 2024

There's a new yield curve in town! - February 2023

Goodbye Quicken! - January 2023

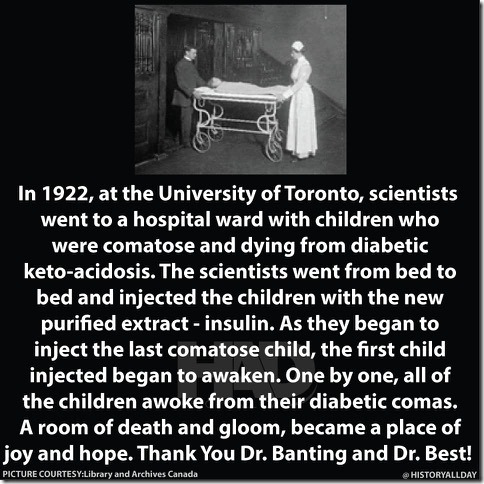

Good medicine - December 2022

CRITICAL: Your vote matters! - November 2022

IMPORTANT if you are over 60 - November 2022

Global warming (aka climate change) - October 2022

Inverted Yield Curve – Updated from May - September 2022

Davey on tour with Elf Power - August 2022

Michael is at the Smithsonian again - virtually - June 2022

Let's Invest! - October 2021

Michael is at the Smithsonian again - virtually - August 2021

The condo collapse - July 2021

Are you demented? - June 2021

Coronavirus websites for you! - November 2020

How to make "mailto" links work properly in Gmail!

Inverted yield curve: Trouble ahead?

Smart-phone apps and Robocall Solution

Inverted yield curve: Recession coming?

Revisit the past

Help! Fight word extinction

Very punny VIII

See Captain Greg on the National Geographic Channel

Michael is again at the Smithsonian June 13

What newspaper do you read?

Signs, signs, everywhere signs...

Join the dumbbell investors club

Bubbles in the news

Very punny VII

Very punny VI

Michael is busy preserving mummies

Darwin Awards

Simply amazing!

Need to shed some pounds?

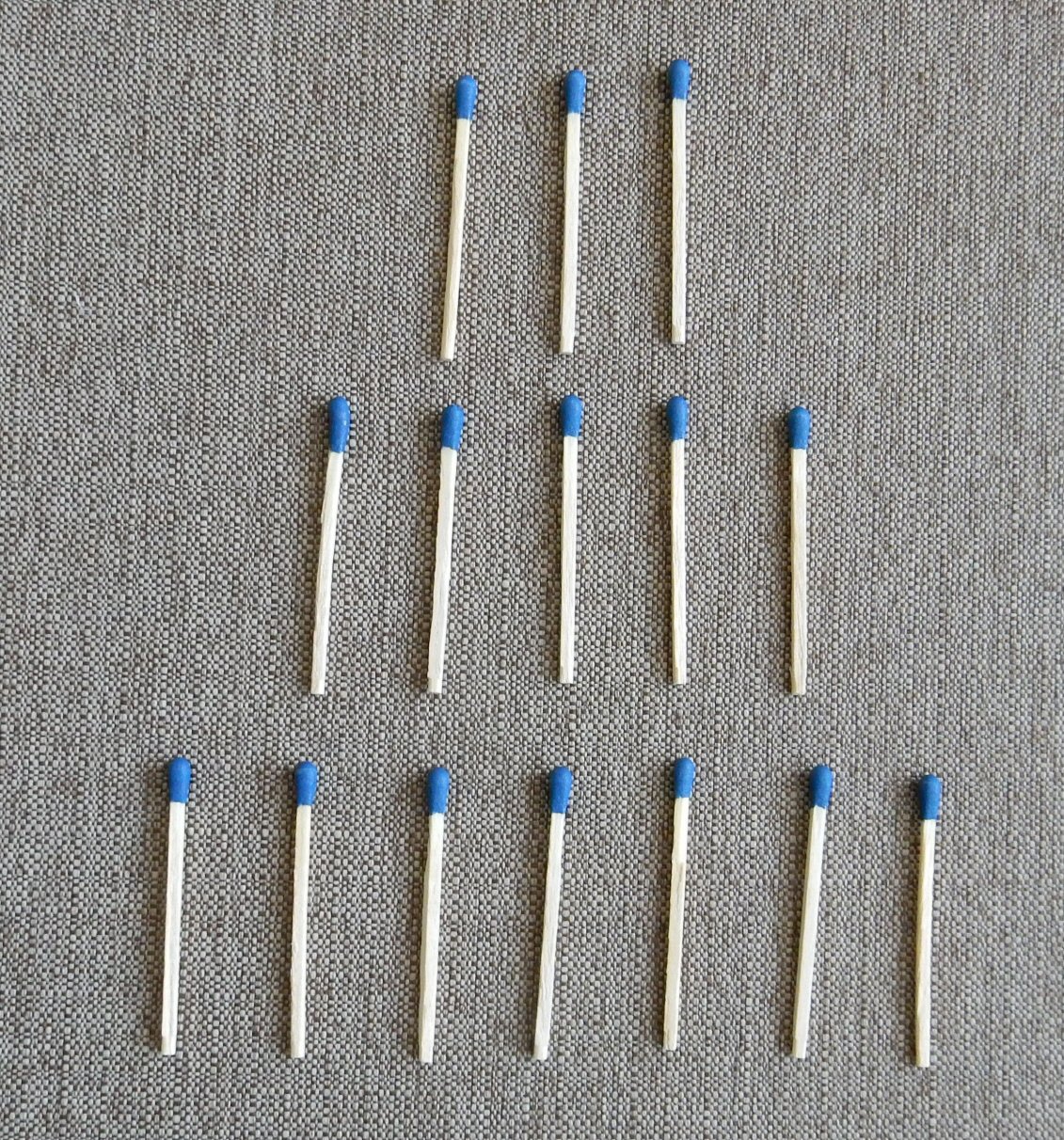

A simple game for anywhere

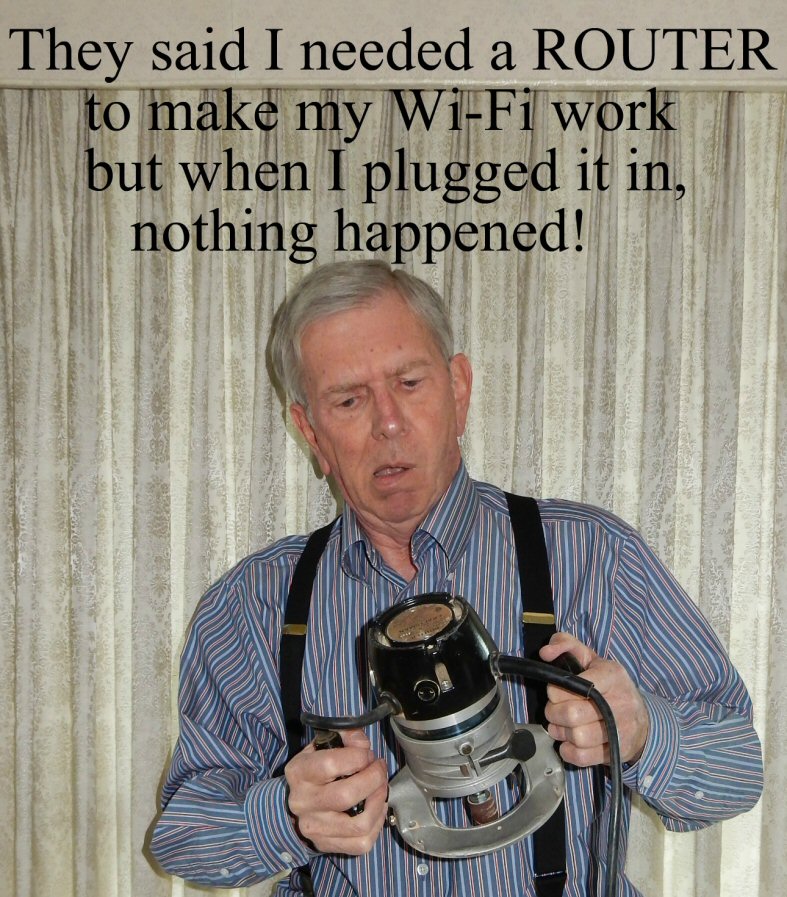

Are You Wireless?

Notable quotes from Yogi Berra

Michael talks at the Smithsonian

Very punny V

Michael sheds light on Dr. Livingstone

From real estate writer Lew Sichelman

Very punny IV

Uncovering Old Medicine

Very punny III

Investment diversity

Have some real fun

Michael continues to push the frontiers of antiquity

Ebola in Reston!

You're From Northern Virginia If...

Smart smart-phone apps

If Your Wallet Disappears

Very punny II

Statins: Can this help anyone you know?

Very punny I

Potpourri: A few things you might use or enjoy...

Interesting, and perhaps even true

Thoughts To Get You Through Any Crisis

Especially Helpful Windows Shortcuts

Investors Glossary

On-line shopping

Thoughts for Today

The internet connection Speed Test

Michael works on ancient Sinai desert manuscripts

Interesting Quotes

[Return to Top]

March 2024 — Trading Guidelines for Investors

Use at your own risk!

- Develop an idea of how long it takes to establish a trend: 3 months? Check the standard moving averages.

- Develop an opinion on whether the market will be higher or lower in 3 months and trade accordingly.

- Buy on the way up, hopefully on a down-day. Sell on the way down, hopefully on an up-day. Consider an inverse (short-selling) ETF on the way down.

- Can you find and use inflection points in the data streams? Remember that most media folks who use that term, do not its meaning and are often referring to a maximum or minimum!

- To confirm a generally rising market trend, gains should be increasing on a good day as 4 PM approaches, and vice versa.

- If you keep enough cash in your portfolio, you can turn a bad day into a buying opportunity.

- The market does not care too much about sales, profits, earnings per share, debt to equity ratios, or other relatively slow-moving measures that we learned about in MBA school.

- The market runs more on emotion (e.g. greed? fear?): How investors feel about the economic situation in general, and which way the market might go next week or next month.

- Utilize temporary market swings due to corporate guidance, Fed talk, inflation expectations, government action or inaction, etcetera, to your advantage: Buy on market negative reactions, sell on positive.

- Try to synchronize your emotional outlook with that of the market trend.

- Avoid combination funds that are called "diversified," "balanced," "growth and income," etcetera. For example, invest in growth funds and income funds separately. Then you will be able to determine how balanced you need to be, and will maintain the flexibility to sell either category separately, for example, for tax reasons. More info here.

- Invest in a single issue, only when you are certain that you are smarter than the market.

- Limit weekly transactions to a maximum of 5% of your portfolio total.

- Avoid buying on a Friday. Only bad things can happen over a weekend.

[Return to Top]

February 2024 — General Guidelines for Investors

- Consider ETFs that include at least 100 individual issues in order to diversify and to minimize volatility. No distinction is made here between ETFs and mutual funds.

- For those with a high-value portfolio. Diversity might include Fidelity in Boston, Schwab in San Francisco, Vanguard in Valley Forge, all cited merely for example. More info here.

- 10 or 12 individual investments are the most that most investors should manage.

- Bonds? Wow, a regular source of income. If individual issues are held to maturity, you will receive the face value, but meanwhile, the value will fluctuate.

- Increase your portfolio's cash position in uncertain times in order to limit losses, and to buy after the market tanks.

- Store your cash in an IRA to avoid taxation as long as possible.

- Hold ETFs (etcetera) in a NON-IRA account so that selling losers can earn a (limited) deduction on next year's income tax.

- Investors who have a lot of dollars (and are market-movers) might not have a lot of sense. Do your own thinking.

- One-third of investors, like the population in general, are out to lunch all the time. Do your own thinking.

- Recognize how strange it is for the market to be moved by what anybody SAYS, and act accordingly.

- Wisdom of the crowds? Forget it!

- Trading algorithms are designed by people, and people make more mistakes than anybody. Will AI do any better?

- Major events, government action, and the general state of the economy can be significant market movers.

- Be alert for self-fulfilling prophecies: The media hyped irrational exuberance in home prices for years. Finally, the Fed got tired of hearing it and cranked up short-term interest rates which blew everyone with a 1-year ARM out of the water causing the great recession.

- The difference between a popular index at 39,999 and 40,001 is merely 0.005%, and is less significant than 5 minutes of market noise. So 40,000 is NOT a BIG deal!

- Making a conscious decision to keep what you do not know separate from what you do know will be an asset. Knee-jerk or herd-instinct investing can have an unhappy ending.

- Common taters: If they were really that smart, they would not waste their time talking to us on TV: They would be sipping champagne on their mega-yachts at the Yacht Club de Monaco, waiting to walk up the hill when the grand Casino de Monte-Carlo is in full swing.

- Recession? The media was all over the inverted yield curve news story, but never realized that the Fed can now distort the yield curve without even trying. Did you ever hear any mention of quantitative tightening, aka QT? Also see inverted yield curve.

- The market price of a company’s stock is constantly approaching that company’s intrinsic value, which changes slowly. Daily fluctuations are merely statistical noise.

- Recognizing the above earned Robert Schiller a Nobel Prize. Rocket science? He used his fame to invent the Case-Schiller real estate report which is patently useless.

- Investor's Glossary.

[Return to Top]

February 2023 — There's a new yield curve in town!

An inverted yield curve, when short-term treasury notes are paying more than long term notes, used to be an indicator of a coming recession: Details. Nowadays it is merely an indicator of whether the Fed (The Federal Reserve Board) is messing with it. Current yields have nothing to do with what the market "thinks." So we might or might not be headed for a recession. Is the sky is falling? Flashback. Your guess is as good as the Fed’s.

The Fed has direct control only over the overnight-funds interest rate, the one that is widely publicized and discussed. However, the Fed's action in that regard spills over and affects short-term notes, including the 2-year. But that's not all: Fed action called quantitative tightening has begun recently.

The Fed is a major player when it comes to U.S. treasury notes. If it weren't, it would not have messed with them in the first place. When it's a buyer's market for anything, the prices go down and the yields go up. The Fed's quantitative tightening program’s purpose is to reduce its holdings of treasury notes. However, it has reduced holdings of short-term notes disproportionately. And it has actually added long-term notes. Details. So when the Fed unloads a lot of 2-year notes, the price goes down and the yield goes up. This, in addition to increases in the overnight-funds rate, puts a double whammy on the 2-year note yield.

A recession? There is hope for a "soft-landing," that is, the Fed taming inflation without causing a recession: In a January, 31 NBC article by Rob Wile one expert noted: "A soft landing is a long shot by any probability — it's never really happened before, . . ." But the national news doesn't matter; it's all personal. If you're doing OK, there's no recession. If you're having a hard time paying your bills and reaching your goals there's a recession. If you're one of the tens of thousands who've been fired by big employers, it's a depression. And when the big guys are unloading employees, the small companies are too. Good luck.

[Return to Top]

January 2023 — Goodbye Quicken!

Most real estate agents are independent contractors, not employees of a company. They don't get a W-2 form and must file a Schedule C with their taxes to account for their business income and expenses. Years ago, I set up a Microsoft Access program to handle this. It included drop-down lists but was very labor intensive.

A few years later I decided to use Quicken. At tax time I printed my custom report, copied a few numbers onto Schedule C, and "voila," my taxes were done. Quicken's greatest feature is that it automatically enters transactions from personal and business checking accounts as well as from various credit cards: A great savings in manual labor. But the Quicken program was a bit wonky and full of more defecation than a Christmas turkey. When something went wrong, I could spend an hour fixing it. Get help from the Quicken computer weenies? Forget it! And then they started charging every year. I would periodically search for an alternative, but there was nothing even worthy of second place.

About 4 years ago I found a Microsoft online program that allowed me to ditch Quicken. Money in Excel downloaded income and expenses that I could easily transfer to an Excel spreadsheet of my own making. Logging in was super-cumbersome, the program needed fixing every month or so, and data wasn't 100% reliable. Nevertheless, it beat Quicken. But it must have been super-cumbersome for the Microsoft computer weenies too. (They get paid more for inventing complicated programs.) So Microsoft announced it was abandoning the program: Thank you very much, Bill.

Then I found Personal Capital, which allows me to automatically capture income and expenses. I still have to do some copying and pasting into my custom Excel spreadsheet, but the program works well. This free offering has simplified my life. Check it out.

[Return to Top]

December 2022 — Good medicine

[Return to Top]

November 2022 — IMPORTANT if you are over 60

In case you haven’t noticed, it’s Medicare Open Enrollment time. (UGH!) It seems that almost everyone adds an insurance plan to the government’s Medicare coverage. Some of these plans are Medicare Advantage plans, also called Part C. But do you want to choose your doctors and hospitals freely, OR select them from the list your insurance company provides? Do you want your insurance company to decide whether you go to the hospital, when you must leave, or how long you get to stay in a nursing home? Don’t you think it would be better for trained medical practitioners to make such important judgments? If you might need coverage when traveling outside your home state, in foreign countries, or on a cruise, now is the time to check. If you are over 60, you need answers to these questions: Read these articles written by my elder-attorney friend Evan Farr: Article #1 and

Article #2.

About half of those on Medicare have a Medicare Advantage plan. But if you want the best medical care available, avoid these plans as if your life depends on it! And it could!

Consider signing up for a Medicare Supplemental Insurance plan (also known as a Medigap plan) which helps fill "gaps" in original Medicare. But trying to sign up for a Medigap plan AFTER you get sick might not work: You must fill out an application and you need to be approved! Also, a medical exam likely will be required.

Medigap plan details vary by state, but there is a guaranteed-issue period for a few months when you first become eligible for Medicare. If you have health issues (i.e., pre-existing conditions), that is the time when you cannot be refused coverage for Medigap plans.

If you are in good health, NOW is the time to make sure you get the best coverage with a Medigap plan. The Open Enrollment period, which began October 15, ends December 7: If you forget, this could become a day that lives in infamy without you.

[Return to Top]

October 2022 — Global warming (aka climate change)

It was almost a disappointing hurricane season: Yikes!

ASTM International, formerly known as the American Society for Testing and Materials, develops and publishes tests and standards for stainless steel, engine fuel and lubricants, dwelling performance, and thousands of other things. Years ago, when I had a real job, I worked on one of its many committees. ASTM has reacted to the global warming scenario with various standards including those noted below.

ASTM should be on the forefront of determining how to measure the average temperature of our Earth. But I can find NO such ASTM standard. Is it leaving such all-important basic measurements to the vagaries of whoever decides to do the measuring? This seems to leave the door wide open for the cherry-picking of data. Am I missing something?

For info:

- ASTM E2137, Estimating Monetary Costs and Liabilities for Environmental Matters

- ASTM E2173, Disclosure of Environmental Liabilities

- ASTM E2718, Financial Disclosures Attributed to Climate Change

- ASTM E2725, Basic Assessment and Management of Greenhouse Gases

- ASTM ????? — Measurement of the Average Global Temperature — Can you find it anywhere?

Meanwhile:

- 97% of climatologists agree that global warming exists.

- 97% of climatologists earn income from global warming.

- 0% of climatologists have told us how they accurately measure the temperature of the entire Earth.

- Where is ASTM when we really need it? Al Gore is no substitute.

Because there was so much trouble explaining how extreme cold spells resulted from global warming, that term was discarded: The term climate change has been adopted to obfuscate the confusion. Global warming/climate change is not a massive conspiracy, but possibly a lot of Lemmingism. A quick calculation suggests we add over 3 billion tons per year of the chief "pollutant" carbon dioxide by breathing! (But don't stop.) No one has proven that global warming is not a significant problem, but no one has proven that it is! Maybe the media will sort it out!

[Return to Top]

September 2022 — Inverted Yield Curve (updated)

An inverted yield curve, when short-term U.S. Treasury notes are paying higher interest rates than long-term notes, might signal that a recession is on the way, but one is certainly not cooked into the books yet. At this point, a recession depends heavily on how aggressively the Fed (Federal Reserve) acts in hiking short-term interest rates as well as its quantitative tightening. The Fed has quite a bit of experience with short-term rates and quantitative easing; that is, buying and holding U.S. Treasurys and mortgage-backed securities. (Yes, that's a bit like smoke and mirrors.) But they have very little experience with quantitative tightening, which increases long-term interest rates.

The rest of the world buys and sells U.S. Treasurys too, and their transactions vary based on world events, such as the war in Ukraine and tensions with Russia and China. So while the Fed's highly publicized action on short-term interest rates can influence the 2-year treasury note, it is "anything can happen day" with the long-term maturities. These are influenced by the mix of major market transactions in long-term notes.

The inverted yield curve might have a reasonable chance of predicting recessions in normal times if presumably-wise bond investors (wisdom of the crowds?) contemplate the future and act accordingly. (This presumes that those with the dollars also have sense.) But as noted above, these are not normal times: The long-term note prices and related yields are being affected in the open market by a few major players. Meanwhile, the Fed is worried about inflation, some of which has been artificially "created" by merely climbing out of the deep economic trough resulting from COVID-19.

Do you remember all those years when the Fed was attempting to attain 3% growth but could never get to even 2%? But the Fed can create a recession, so let's plan for the worst and hope for the best. And as an infamous man once said, "Time will tell."

Note 1: Economic dislocation did follow the 2019 inverted yield curve alarms, but that was certainly a result of COVID-19 and not a valid prognostication. See a pre-COVID entry: September 2019.

Note 2: In any event, the 10-year U.S. treasury note is a harbinger of mortgage interest rates. So stay tuned!

[Return to Top]

August 2022 — Davey on tour with Elf Power.

Elf Power, one of the Athens bands my son Davey is in, has released a new CD and finished their tour which included a recent appearance at DC’s Black Cat club. They did European tours in 2020 and 2021. Davey is quoted several times in the book Endless Endless detailing the Athens Georgia Elephant-6 Collective which includes REM and the B52s.

Meanwhile, Davey has not quit his day-job, teaching at the University of Georgia. Here is the tour schedule . . .

- July 13 2022 - Evanston, IL @ Space

- July 14 2022 - Chicago, IL @ Schuba's Tavern

- July 15 2022 - Louisville, KY @ Portal Creative Compound

- July 16 2022 - Detroit, MI @ El Club

- July 17 2022 - Cincinnati, OH @ MOTR Pub

- July 18 2022 - Columbus, OH @ Natalie's Grandview

- July 19 2022 - Pittsburgh, PA @ Club Café

- July 20 2022 – Millersville, PA (Lancaster)

- July 21 2022 - Somerville, MA @ Crystal Ballroom of MA

- July 22 2022 - Providence, RI @ Columbus Theatre

- July 23 2022 - New York, NY @ Le Poisson Rouge

- July 24 2022 - Hamden, CT @ Space Ballroom

- July 25, 2022 Philadelphia, PA @ Johnny Brenda's

- July 26 2022 - Washington, DC @ Black Cat

- July 27 2022 - Carrboro, NC @ Cat's Cradle

- July 28 2022 - Columbia, SC @ New Brookland Tavern

- July 29 2022 - Atlanta, GA @ 529

- July 30 2022 - Athens, GA @ 40 Watt Club

[Return to Top]

June 2022 — "See" Michael at the Smithsonian virtually

Palimpsests: Hidden Texts Revealed by Technology

Palimpsests are ancient parchment manuscripts whose original text has been scrubbed off and have then been overwritten.

Many of you know Michael from social events and from the Lady Katie on the Bay. He has an interesting second career and is a regular presenter at the Smithsonian.

Michael was featured in the June 2021 issue of

Northern Virginia Magazine as well as the May 2021 issue of

Washingtonian. Years ago Michael decoded the Archimedes Palimpsest which appeared for years at the Walters Art Museum, in Baltimore.

Here are previous posts ...

August 2021 — A New Frame for Art Research

June 2017 — How to Make the Mummies Talk

December 2016 — Michael is busy preserving mummies

February 2016 — Michael talks drugs at the Smithsonian

December 2015 — Michael sheds light on Dr. Livingstone

July 2015 — The secrets of early medicine

Decenber 2014 — An interview with Michael

March 2013 — Saint Catherine's Monastery in the Sinai

[Return to Top]

October 2021 — Let's Invest!

Let's invest in stocks! Where do we start? Which companies are best? There's a lot of information out there: Sales, earnings, debt-to-equity ratios, stock price to earnings ratios, dividends, etcetera. Hhhhmmmm. All the important stuff that we learned in MBA school. But can we predict the future of a company from its history? And does it matter? And what about expectations?

When we see a company's stock price go up or down by 10% or 15% in a day, what does it mean? The company's underlying value can certainly not change that fast, so what is going on? The answer is emotion: Likely greed or fear! This is reinforced when we see a stock price or the entire market influenced by someone's comment. It does not seem to matter that some of the comments emanate from certified nuts! It’s all much more like legalized gambling.

You can certainly do well if you have inside information or are smarter than everyone else. That certainly disqualifies me and likely many others. (Editor's note: Some Federal Reserve regional presidents have really been nailing it!) The pundits who are telling you they have all the answers, certainly do not. If they did, they would be on their 160-foot yacht anchored in Monaco enjoying the good life at Casino de Monte-Carlo, a short taxi ride away if they want to avoid walking up the hill. They would have neither the time nor the inclination to tell us their secrets. And let's remember that a pundit who has a lot of dollars does not necessarily have a lot of sense.

Robert Shiller won the Nobel Prize by telling us that each company has an intrinsic value toward which its stock price will trend in the long run. (No, the prize was not won for the Case-Shiller Index, which is pure bullcrap: Can discuss.) It kinda just sounds like common sense, but the Scandinavians were impressed. In the long run, stock values have increased. There hasn't been a horrific downturn that hasn't been followed by a significant recovery. So, let's forget the value of individual companies, which might lead to the wrong investment, and result in the loss of everything. Sharp downturns are driven by fear, while recoveries are driven by hope, which builds slowly over time. Both share a foundation of greed.

While investing in individual stocks might seem lucrative for a while, it certainly can prove downright dangerous. But there are now these things called exchange-traded funds, or ETFs, thanks to John Bogle and his Vanguard 500 fund from 1976. By investing in 500 companies, even if one or two or three go down the drain, you will still be OK. But if these 500 stocks shed 23% of their value someday, like what happened on October 19, 1987, they will come back at some point. If 500 stocks go down the drain forever, we have bigger problems than just losing a fortune. There are hundreds of ETFs to choose from, but you might favor funds that have at least 100 stock issues in their portfolio. (If you’re asking me.) And let's remember:

1-It's only money

. . . and . . .

2-In the long run, there is no long run.

[Return to Top]

August 2021 — See Michael at the Smithsonian again — virtually this time

Many of you know Michael from social events and from the Lady Katie on the Bay. He has an interesting second career and is a regular presenter at the Smithsonian. He will be appearing again virtually on August 25. Book your "seat" here, and Michael will visit you at home.

Michael has recently been featured in the June issue of

Northern Virginia Magazine as well as the May issue of

Washingtonian. Years ago Michael decoded the Archimedes Palimpsest which appeared for years at the Walters Art Museum, in Baltimore.

Here are previous posts ...

June 2017 — How to Make the Mummies Talk

December 2016 — Michael is busy preserving mummies

February 2016 — Michael talks drugs at the Smithsonian

December 2015 — Michael sheds light on Dr. Livingstone

July 2015 — The secrets of early medicine

Decenber 2014 — An interview with Michael

March 2013 — Saint Catherine's Monastery in the Sinai

[Return to Top]

July 2021 — The condo collapse

We once had a real home but became high-rise condo converts in 2009. The 2021 disaster in Surfside, Florida, certainly seems unique. But how unique is it? A first thought was that the builder might have used saltwater to mix the concrete for the original construction, but that might be a bit far-fetched. If the building was sinking 2 millimeters annually for 40 years, the total would be more than 3 inches, which is a helluva lot, and certainly contributed to the collapse.

Concrete corrosion and degradation (aka spalling) are occurring constantly and can reach a point at which they should not be ignored. Spalling is caused by corrosion of the steel (rebar) reinforcing the concrete and the separation of one from the other. This adversely affects a structure’s strength and is often the result of water infiltrating concrete, which is inherently porous. In costal Florida this is often due to saltwater, which is especially corrosive, but farther north can be the result of repeated freezing and thawing in addition to corrosion. Visible signs include cracks in the concrete as well as chunks of concrete separated from the structure. Remediation is possible and should always be considered when there are visible signs in a building’s supporting columns. Rust stains on the concrete are another telltale sign of potential problems.

Our Palm Beach unit is on the 18th floor about a mile from the ocean and we certainly get saltwater on our windows under certain conditions. (Champlain Towers was on the oceanfront about 70 miles south.) Our concrete is certainly penetrated by some of the saltwater. This is a well-known problem. Our building recently underwent a 1-year project for affected areas, which produce a hollow sound when tapped. These areas were jackhammered to expose the corroded rebar, which was cut out and replaced with new steel and concrete. Our building has undergone this structural work about every 10 to 15 years. Many thanks to our condo association which stays on top of this, including required engineering studies and maintaining required reserves.

[Return to Top]

June 2021 — Are you demented?

Here is a widely used test for mental acuity. It consists of 30 questions you can complete in about 15 minutes

online or

on paper. You will need a blank sheet of paper, a pen or pencil, and someone to administer the test. No training needed.

Never in the news: This likely is the test administered to President Trump when he was rushed to Walter Reed Hospital for that unscheduled visit on a Saturday afternoon in November 2019. Why did he go? The most likely explanation is TGA: Transient global amnesia. This scary condition can appear suddenly without warning, and there are no known causes. Those afflicted remember very little other than their name, but they can recognize familiar faces. They tend to keep asking the same questions repeatedly:

- Where am I?

- What time is it?

- Why are we here?

The condition is not serious, there is no known treatment, and it usually passes within a day. But for those in the presence of someone with TGA, it is scary indeed. The president said he "aced" the test. How did you do?

[Return to Top]

November 2020 — Coronavirus websites for you!

Here are some interesting websites for those who believe there is a virus out there.

- A chart estimating the risk of infection from various activities.

- Wondering whether you should seek medical care? Click here.

(This CDC Coronavirus Self-Checker takes about 5 minutes to complete.) - Risk of attending an event by county and number of attendees.

- A tool for predicting your COVID-19 test result. From Cleveland Clinic.

- A risk score calculator to determine your chance of infection and mortality. Read your specific comments. This might only work using the Google Chrome browser. From 19 and Me.

- Department of Homeland Security airborne virus decay calculator.

- Johns Hopkins data by county. Zoom in on the map and click on the county or the red dot.

- Data by state with 3-month projections. From Institute for Health Metrics and Evaluation.

- Data by state. From Worldometer.

- Virginia Department of Health info. (With a search function.)

[Return to Top]

May 2020 – Make "mailto" links work properly in Gmail!

For Windows users using the Chrome browser and Gmail.

- First, go to settings in Windows and be sure that your "Default Apps" MAIL setting for MAILTO is Google Chrome.

- Click mailto:yfire1@gmail.com

- If this took you to the "Subject" line in the Gmail "New Message" compose box, you have no problem.

- If it did not, open your Chrome browser and click the three small dots in the upper right corner.

- Then click "Settings" in the drop-down menu.

- Click "Privacy and security" in the left menu.

- Scroll down and click "Site Settings"

- Scroll down and click "Additional pemissions"

- Click "Protocol handlers" and notice the two tiny diamonds on the left.

- Turn on the "Sites can ask to handle protocols" radio button, and also unblock any email programs that are listed as blocked, especially Gmail!

- Open Gmail and click the two tiny diamonds (as seen in the "Handlers" section) on the right side of the top address box. They are in the grayed-out area just to the left of the star.

- Click the radio button to the left of "Allow."

- Then click "Done."

- Again click mailto:yfire1@gmail.com

- If this took you to the "Subject" line in the Gmail "New Message" compose box, you have resolved your problem.

- If not, good luck!

[Return to Top]

September 2019 — Inverted yield curve: Trouble ahead?

The sky is falling! The sky is falling! Have you heard the news? The yield curve is inverting again: The U.S. 2-year bond is yielding more than the 10-year bond. Such an event signaled the 2007/2008 recession and several recessions before that.

Longer-term bond yields (5-, 10-, and 30-year) are a bit volatile from time to time but they generally have been decreasing in concert for at least 30 years. The shorter-term notes followed suit for most of that time but have adopted a strikingly unusual pattern since 2007/2008. The Federal Reserve Board (Fed) controls short-term overnight interest rates, (currently set at 2.25%) and short-term bonds such as the 2-year (and the 3-month) are being affected upward by the Fed, not the market.

Further, the Fed was starting to sell the trillions of longer-term bonds it had accumulated in its quantitative-easing program. Those sales tended to increase rates on longer-term bonds and might have prevented the yield curve inversion. But the Fed announced a while back that it was ending those sales.

If a recession is really coming, this is not the harbinger. It is not the wisdom of the crowds but an unnatural perturbance foisted on bond yields by the Fed. Remember where you heard it first.

Editor's note: See my earlier thoughts on the inverted yield curve, and my brief exposé of the 2007/2008 debacle.

[Return to Top]

May 2019 — Smart-phone apps and Robocall Solution

Robocall Solution: Call Control for Android or iPhones. Try it free for a week, then get 3 months for $10. The beauty: It lets you use wild cards! I was getting up to 12 calls a day from 267-756-2XXX, in which the last three digits varied at random. This app works well, but it might take some trial and error to get it set up as you want.

Tip 1: To be sure your phone is connected to the strongest cell signal, turn airplane mode on, then off.

Tip 2: Listen to WTOP radio anywhere by calling 202-380-9977

The following are Android apps, but the same or similar ones are no doubt available for I-phones.

- Network Cell Info Lite — Checks the strength of your cell and wireless signals

- First Aid — Quickly access life-saving information

- GasBuddy — Find the cheapest or closest fuel

- iExit — Locate gas, food, lodging, etcetera at the next several Interstate exits

- Waze — Find out what's on the road ahead, the speed limit, your speed, and lots more

- Google Drive — Store files and access them on your phone

- Google Maps — Get current traffic conditions and GPS directions

- Sound Meter — How loud is your neighbor's stereo? Find out with this app

- Gauss Meter — Is there a gauss (electromagnetic radiation) in the house? Also check out power lines or a transformer installation

- QR Droid — Read UPC and QR codes (e.g. on YFiRE signs)

- RadarNow! — View weather radar and receive weather alerts

- SpeedView — How fast you are really going?

- Compass

You likely received these useful apps with your phone.

- Mobile Hotspot to connect your computer to the Internet

- Clock with an alarm and stopwatch

- Calculator

- Flashlight

Ask about specialized marine or real estate apps, and let me know if I missed one of your favorites.

[Return to Top]

April 2019 — Inverted yield curve: Recession coming?

The sky is falling! The sky is falling! Have you heard the news? The yield curve is inverting: Short-term bonds are yielding more than long-term bonds.

What the media forgot: The Fed is selling billions of Treasuries every month, which might be introducing perturbances. If it sells more short-term bonds, the extra supply would push the price down and the yield up, possibly higher than long-term bonds. Hhhmmmm.

Some of the recent media grousing referred to the 3-month note, whose yield has been rising for a year or so. When the Fed raises overnight interest rates, as it has been doing for a year or so, short-term notes like the 3-month are most affected. Duh!

The long-term bond yields are merely back to where they were a year ago. If a recession is really coming, this is not the harbinger. Remember where you heard it first.

(Editor's note: Janet Yellen sees it my way.)

Some still see a recession coming: The last time the yield curve inverted was 2007, and we all remember what happened then. But conditions then were much different. See my brief exposé of that debacle.

. . . and while we're celebrating the best first quarter since 1998, let's take a moment to reflect on where we started from: December 31, 2018.

[Return to Top]

November 2018 — Have you ever heard someone say ...

- It's your nickel.

- Number please?

- Kilroy was here.

- We were in like Flynn. (Hhhmmmm)

- Living the life of Riley.

- We were hung out to dry.

- Wake up and smell the roses.

- Don't take any wooden nickels.

- . . . when I get a round-tuuit.

- Put on your best bib and tucker.

- You sound like a broken record.

- He was just knee high to a grasshopper.

- Wonder where Superman will find a phone booth?

- See ya later, alligator. / After while crocodile.

- More . . . than Carter has little liver pills.

- It takes one to know one.

- Don't touch that dial.

- Stay tuned.

Styles that are not returning soon ...

- Hair: Beehives; pageboys; and the D.A.

- Clothing: spats; knickers; fedoras; poodle skirts; pedal pushers; and hi-rise, pegged, and saddle-stitched pants.

[Return to Top]

October 2018 — Help! Fight word extinction

Please resolve to use at least one of these words every day . . .

- Swell

- Pshaw

- Hey!

- YO!

- Jalopy

- Knucklehead

- Nincompoop

- Hunky-dory

- Carbon copy

- Okie dokie

You're over 50 years old if you say "you're welcome," and when is the last time you exclaimed . . .

- Holy moley!

- Gee whillikers!

- Heavens to Betsy!

- Heavens to Murgatroyd!

- Straighten up and fly right!

- Not for all the tea in China!

- Well, I'll be a monkey's uncle!

- This is a fine kettle of fish!

- Jumpin' jehoshaphat!

- Oh, my aching back!

- Fiddlesticks!

Do you know . . .

What time of day does the sandman visit?

or . . .

What evil lurks in the hearts of men? If you do not know, who does know?

[Return to Top]

August 2018 — Very punny VIII

- If attacked by a mob of clowns go for the juggler

- This is my step ladder I never knew my real ladder

- My wife said I never listen to her or something like that

- Went to the air and space museum but there was nothing there

- If your car is running I'm voting for it

- What happens if you get scared half to death twice?

- I want to grow my own food but I can't find bacon seeds

- They're not going to make yardsticks any longer

- If you think education is costly, try ignorance

- Practice safe eating: Always use condiments

- The past, present, and future walk into a bar. It was tense

- Ban pre-shredded cheese: Make America grate again

- Frog parking only, all others will be toad

- I child-proofed my house but the kids still get in

- Is there ever a day that mattresses are not on sale?

- The first 5 days after the weekend are the hardest

- I checked in to the Hokey Pokey Clinic and I turned myself around

[Return to Top]

July 2018 - See Captain Greg on the NatGeo Channel

The Wicked Tuna Outer Banks 2018 weekly series begins at 9pm Sunday July 1. I have been fishing on the Fishin' Frenzy since 1999. Click here for details.

[Return to Top]

June 2018 - Michael is again at the Smithsonian June 13

Click here for details.

[Return to Top]

May 2018 — What newspaper do you read?

- The Wall Street Journal is read by the people who run the country.

- The Washington Post is read by people who think they run the country.

- The New York Times is read by people who think they should run the country, and who are very good at crossword puzzles.

- USA Today is read by people who think they ought to run the country but don't really understand The New York Times.

- The Los Angeles Times is read by people who wouldn't mind running the country, if they could find the time and if they didn't have to leave Southern California to do it.

- The Boston Globe is read by people whose parents used to run the country.

- The New York Daily News is read by people who aren't too sure who's running the country and don't really care as long as they can get a seat on the train.

- The New York Post is read by people who don't care who is running the country as long as they do something really scandalous, preferably while intoxicated.

- The Chicago Tribune is read by people who are in prison, who used to run the state, and would like to do so again, as would their constituents who are currently free on bail.

- The Miami Herald is read by people who are running another country, but need the baseball scores.

- The San Francisco Chronicle is read by people who aren't sure if there is a country or that anyone is running it; but if so, they oppose all that they stand for.

- The National Enquirer is read by people trapped in line at the grocery store.

- The Seattle Times is read by people who have recently caught a fish and need something to wrap it in.

[Editors note:] If you read any newspaper, you were likely born before 1950. If you were born after 1975, just google up "newspaper" for more infomation.

[Return to Top]

February 2018 — Signs, signs, everywhere signs...

- In a shoe repair store:

"We will heel you

We will save your sole

We will even dye for you."

- On a Tire Shop in Milwaukee:

"Invite us to your next blowout."

- In a Veterinarian's waiting room:

"Be back in 5 minutes. Sit! Stay!"

- In front of a Funeral Home:

"Drive carefully. We'll wait."

- At a Propane Filling Station:

"Thank Heaven for little grills."

- In a Chicago Radiator Shop:

"Best place in town to take a leak."

- On a Plumber's truck:

"We repair what your husband fixed."

- On another Plumber's truck:

"Don't sleep with a drip. Call your plumber."

- Outside a Muffler Shop:

"No appointment necessary. We hear you coming."

- In an Optometrist's Office:

"If you don't see what you're looking for, you've come to the right place."

- At the Electric Company:

"We will be delighted if you send your payment on time. However, if you don't, you will be de-lighted."

[Return to Top]

January 2018 — Join the dumbbell investors club

This is about dumbbell investing. If you buy and hold individual stocks or bonds, you do not need to read this. However, if you buy funds and plan to sell them someday, this idea is for you.

You should consider avoiding funds that are called "diversified," "balanced," "growth and income" etcetera. Instead, for example, invest in growth funds and income funds separately to accomplish the same objective. For similar reasons, you should also…

- keep stocks and bonds in separate funds

- keep domestic and overseas investments in separate funds

- keep growth stocks and income-producing stocks in separate funds

- and avoid the S&P 500 funds (like SPY) in favor of Dow industrial funds (like DIA) in combination with NASDAQ funds (like QQQ).

The reason is relatively simple. When it's time to sell you might want to maximize your gains or even maximize your losses. Your ability to do this will be enhanced greatly by investing in funds that are at the extreme ends of what you are trying to accomplish. Hence the term dumbbell. With funds that are a mix, an amalgamation, or are trying to accomplish two dissimilar goals, you will have a limited choice of what to sell to accomplish your goal.

For an entirely different slant on investment diversity, click alternate idea #1 and alternate idea #2.

[Return to Top]

December 2017 — Bubbles

What's this all about? 'They're forever blowing bubbles, ugly bubbles on the air ...' (Does anyone remember the song from 1918? As a kid I played it on my Grandmother's wind-up Victrola!)

Did you ever see a bubble? Did you ever see a bubble burst? What was left? Absolutely nothing! (Say it again?)

A recent blurb on national media cited four cities including the Washington DC area where home prices are so high that they are unsustainable. The word bubble was used. Without great detail, home prices represent the wisdom of the crowds. The only ones who get to decide if prices are too high are you and me, and only when we're buying a home. The opinion of some "doo-dah expert" might be news, but it is worthless as information.

Also in the media recently, a bubble in bonds was cited. Bonds are a bit different from homes in that there is a national bond market. Its existence distinguishes bond prices from home prices, for which there is no national market, even though national averages can be calculated and reported for both.

Fast-backward 15 years: The media was finally correct about problems in the real estate market, but only after 5 years of grousing about a bubble. Meanwhile they cited a variety reasons, none of which proved correct. If they cared, or had more than half a brain, the story would have detailed mortgage fraud, a factor that was never mentioned. (But don't get me started. OK, click here for more info.)

The media could be right or wrong about where home prices and bond prices are headed. But one thing is for sure: If and when their "bubble" bursts, there will be a lot more left than nothing.

What's the point? This is not about home prices or bond prices, this is about the spin the media puts on everything. Bubble is a lot more attention-getting than "downturn," "decline," or "adjustment." As we get our news, we must always remember that their number one job is to get attention and ratings. A mundane word will never do if a more sensational one is available.

If you're using the news media for information with which you can generate an informed opinion, take action, or make a reasonable judgement, good luck! Most of it is just entertainment.

[Return to Top]

February 2017

- Velcro: What a rip off!

- Broken pencils are pointless.

- When you get a bladder infection, urine trouble.

- I dropped out of communism class because of lousy Marx.

- What's a dinosaur with an extensive vocabulary? A thesaurus.

- All the toilets in the police station have been stolen. The police have nothing to go on.

- Did you hear about the cross-eyed teacher who lost her job because she couldn't control her pupils?

- I got a job at a bakery because I kneaded dough.

- Don't worry about old age; it doesn't last.

[Return to Top]

January 2017

- Venison for dinner again? Oh deer!

- I used to be a banker, but then I lost interest.

- Haunted French pancakes give me the crêpes.

- I didn't like my beard at first. Then it grew on me.

- I changed my iPod's name to Titanic. It's syncing now.

- Why were the Indians here first? They had reservations.

- England has no kidney bank, but it does have a Liverpool.

- A cartoonist was found dead in his home. Details are sketchy.

- I know a guy who's addicted to brake fluid, but he says he can stop any time.

[Return to Top]

December 2016 - Michael is busy preserving mummies

Click here for the full story.

[Return to Top]

October 2016 - Darwin Awards

The Darwin Award is an annual honor given to the person who provided the human gene pool the biggest service by getting killed in the most extraordinarily stupid way. The folks below are semi-finalists.

- In Detroit, a 41-year-old man got stuck and drowned in two feet of water after squeezing head first through an 18-inch-wide sewer grate to retrieve his car keys.

- A 49-year-old San Francisco stockbroker, who "totally zoned when he ran," according to his wife, accidentally jogged off a 200-foot-high cliff on his daily run.

- Santiago Alvarado, 24, was killed in Lompoc, CA, as he fell face-first through the ceiling of a bicycle shop he was burglarizing. Death was caused when the long flashlight he had placed in his mouth (to keep his hands free) rammed into the base of his skull as he hit the floor.

- In Dahlonega, GA, ROTC cadet Nick Berrena, 20, was stabbed to death by fellow cadet Jeffrey Hoffman, 23, who was trying to prove that a knife could not penetrate the flak vest Berrena was wearing.

- Sylvester Briddell, Jr., 26, was killed in Selbyville, Del., as he won a bet with friends who said he would not put a revolver loaded with four bullets into his mouth and pull the trigger.

- According to police in Windsor, Ontario, Daniel Kolta, 27, and Randy Taylor, 33, died in a head-on collision, thus earning a "tie" in the game of chicken they were playing with their snowmobiles.

- A 7-year-old boy fell off a 100-foot-high bluff near Ozark, Ark, after he lost his grip swinging on a cross that marked the spot where another person had fallen to his death a few years before.

[Return to Top]

September 2016 - The amazing Turbo-Encabulator

Work has been proceeding in order to bring perfection to the crudely conceived idea of a device that would not only supply inverse reactive current for use in unilateral phase detractors, but would also be capable of automatically synchronizing cardinal grammeters. Such an instrument is the turbo-encabulator.

The novel principle involved is that instead of power being generated by the relative motion of conductors and fluxes, it is produced by the modial interaction of magneto-reluctance and capacitive diractance.

The original machine had a base plate of pre-famulated amulite surmounted by a malleable logarithmic casing in such a way that the two spurving bearings were in a direct line with the panametric fan. The latter consisted simply of six hydrocoptic marzlevanes, fitted to the ambifacient lunar waneshaft so that side fumbling was effectively eliminated.

The main winding was of the normal lotus-o-delta type placed in panendermic semi-boloid slots of the stator, every seventh conductor being connected by a non-reversible tremie pipe, to the differential girdle spring on the "up" end of the grammeters.

The turbo-encabulator has now attained a high level of development, and has being successfully used in the operation of novertrunnions. Moreover, whenever a forescent skor motion is required, it may also be employed in conjunction with a deep-drawn reciprocating dingle arm, to reduce sinusoidal repleneration.

I am taking questions.

David Rathgeber, BSME (aka YFiRE)

25 year member: Society of Automotive Engineers (SAE)

[Return to Top]

August 2016 - Need to shed some pounds?

Don't try this at home!

[Return to Top]

July 2016 - A simple game

If you find this game infectious, there is no anecdote!

Start with rows of 3, 5, and 7 matchsticks (or any other objects) as shown below. Two players take any number of matchsticks from only one row alternately. The player who takes the last matchstick loses.

[Return to Top]

June 2016 - Are You Wireless?

If you can read this, itz working fine.

All I had to do was cut the cord off: Wireless!

[Return to Top]

April 2016 - from Yogi Berra

- When you come to a fork in the road, take it.

- You can observe a lot by just watching.

- No one goes there nowadays, it's too crowded.

- We made too many wrong mistakes.

- I usually take a two-hour nap from one to four.

- Never answer an anonymous letter.

- The future ain't what it used to be.

- I'm not going to buy my kids an encyclopedia. Let them walk to school like I did.

- The towels were so thick there I could hardly close my suitcase.

- I never said most of the things I said.

[Return to Top]

February 2016 - Friend Michael talks at the Smithsonian

Click here for information and tickets for February 23rd. Mike will discuss his luminary work to uncover 2nd-century Greek physician Galen's text "On the Mixtures and Powers of Simple Drugs."

[Return to Top]

January 2016

- If you jumped off the bridge in Paris, you'd be in Seine.

- The midget fortune-teller who escaped from prison was a small medium at large.

- In a democracy it's your vote that counts. In feudalism it's your count that votes.

- The fattest knight at King Arthur's round table was Sir Cumference. He acquired his size from too much pi.

- Someone sent ten puns to a friend with the hope that at least one would make them laugh. No pun in ten did.

- When cannibals ate a missionary, they got a taste of religion. When they tried a clown, one asked the other, "Does this taste funny to you?"

- A backward poet writes inverse.

- A lawn sign at a drug rehab center said: "Keep off the Grass."

[Return to Top]

December 2015 - Michael sheds light on Dr. Livingstone

From the November 2014 Smithsonian Magazine article Decoding the Lost Diary of David Livingstone

[Return to Top]

October 2015 - From real estate writer Lew Sichelman

- August 2014 Los Angeles Times — Shortcomings of the data

- August 2013 Los Angeles Times — Pricing your home

- November 2002 Chicago Tribune — The round number theory

- September 2000 Chicago Tribune — Future home prices

- August 2006 Chicago Tribune — Negotiating considerations

- December 2006 Chicago Tribune — Home prices

[Return to Top]

September 2015

- A rubber band pistol was confiscated from algebra class, because it was a weapon of math disruption.

- A hole has been found in the nudist camp wall. The police are looking into it.

- Two silk worms had a race. They ended up in a tie.

- I thought I saw an eye doctor on an Alaskan island, but it turned out to be an optical Aleutian.

- A dog gave birth near the road and was cited for littering.

- A grenade thrown into a kitchen in France would result in Linoleum Blownapart.

- Atheism is a non-prophet organization.

- Two hats were hanging on a hat rack. One hat said to the other: "You stay here; I'll go on a head."

- She was only a whisky maker, but he loved her still.

[Return to Top]

July 2015

Friend Michael helps to uncover the secrets of early medicine according to this recent New York Times article. Let me know if you'd like to attend his next talk at the Smithsonian.

[Return to Top]

April 2015

- I tried to catch some fog, but I mist.

- When chemists die, they barium.

- Jokes about German sausage are the wurst.

- The soldier who survived mustard gas and pepper spray is now a seasoned veteran.

- I know a guy who's addicted to brake fluid. He says he can stop anytime.

- How does Moses make his tea? Hebrews it.

- I stayed up all night to see where the sun went. Then it dawned on me.

- She said she recognized me from the vegetarian club, but I'd never met herbivore.

- I did a theatrical performance about puns. It was a play on words.

- They told me I had type A blood, but it was a Type O.

- A dyslexic man walked into a bra.

[Return to Top]

February 2015 - Investment diversity

We have all heard of Enron and Bernie Madoff, who made off with the money. And there are hundreds more examples out there. No doubt we have also heard: "Don't put all your eggs in one basket." Incredibly, folks lose everything because they do not heed that advice. Why do they continue down such a path? Simply because it seems to work. Do you recognize the name Ponzi? The end comes quickly, so now is the time to examine our own situation.

Every market has its ups and downs: Stocks, bonds, commodities (there's gold in them-thar bags), and even real estate. Only insured deposits and CDs seem fairly safe. We should have at least 3 types of investments; and yes, we can count our homes as investments. Mutual funds, exchange traded funds (ETFs), et cetera provide diversity in many companies and countries.

OK, we've got it! But wait there's more. Did you ever hear of Lehman Brothers? AIG? 911? We should distribute our investments across various companies located in different cities. For example: Fidelity in Boston; Schwab in San Francisco; Vanguard in Valley Forge. And let's not forget to have at least a few CDs at the local branch of our favorite bank, which might be headquartered in Charlotte. If something terrible happens to one company or at one location, your money will be better positioned. Hopefully, it will not all be stored in the same cloud!

And last, Madoff revisited: If we have a financial advisor with signature authority over our investments, we need to ensure that the advisor is affiliated with a name-brand outfit and has a legal agreement that makes him or her a fiduciary. But your advisor being a fiduciary will not obviate all problems, so we should never let one advisor manage more than we can afford to lose.

Of course, this is just the tip of the iceberg. But a little thought and effort now, when everything seems fine, could be a lifesaver (aka PFD in nautical terms) some day. Or, if you want to avoid all the anxiety, just take your money and dump it into a big hole in the water (translation: boat). Problem solved!

[Return to Top]

January 2015 - Have some real fun

- Sing along at the opera.

- At lunch time, sit in your parked car with sunglasses on and point a hair dryer at passing cars. See if they slow down.

- Page yourself over the intercom. Don't disguise your voice!

- Tell your children over dinner, 'due to the economy, we are going to have to let one of you go.'

- Specify that your drive-through order is 'to go.'

- Five days in advance, tell your friends you can't attend their party because you have a headache.

- When the money comes out the ATM, scream 'I won! I won!'

- Order a diet water whenever you go out to eat, with a serious face.

[Return to Top]

December 2014

Friend Michael continues to push the frontiers of antiquity. This work on Dr. Livingston's hidden writing follows his work at Saint Catherine's Monastery in the Sanai desert and his work helping to uncover the secrets of the Archimedes Palimpsest. His next talk at the Smithsonian is not yet scheduled.

[Return to Top]

November 2014

Ebola in Reston! Check out the

Hot Zone!

[Return to Top]

September 2014 - You're From Northern Virginia If...

- You have no idea what at least 2 of your friends do because it's "top secret" government work

- The cars in the local high school's student parking lot are worth 3 times those in the teacher parking lot

- You've never told someone you're from Virginia without putting "northern" in front of it

- When people ask where you're from, you tell them "DC" because it's easier to explain

- Helicopters, F-15s, 757s flying above your neighborhood are a normal occurrence

- You do your Christmas shopping online because the shopping malls have no open parking spots

- When you were driving on the Beltway at 3:13am on a Tuesday there was still traffic

- It's not actually tailgating unless your bumper is touching the car in front of you

- If you stay on the same road long enough, it will eventually have 3 new names

- A slow driver is someone who isn't going at least 10mph over the speed limit

- For the cost of your house, you could own a small town in Iowa

- There are at least 3 malls within 20 minutes of your house

- There are at least 6 Starbucks within 10 minutes of your house

- You can cross 4 lanes of traffic in under 30 seconds

- It often takes you 30 minutes to drive 5 miles

- When traveling, you have your choice of 3 airports

- An inch of snow and you miss 3 days of work

- Your local news is national news.

[Return to Top]

August 2014 - Smart smart-phone apps

The following are Android apps, but same or similar ones no doubt are available for I-phones.

- Gas Buddy - Find the cheapest or closest fuel

- Interstate Exits Guide - Gas, food, etc at the next exit

- Mobile Hotspot - Connects your computer to the Internet

- Google Drive - Store anything and access it from your phone

- Google Maps - With current traffic and GPS directions

- Gauss meter - Is there a gauss in the house?

- Calculator

- News & Weather

- CNBC - Are you winning or losing?

- Radar Now - Weather radar

- Clock - With an alarm

- Ultrachron - Stop watch

- Sound meter - Noisy neighbor?

- Speed View - Speedometer

- TuneIn Radio - Hear your favorite station on your phone

- QR Droid - Read UPC and QR codes (e.g. on YFiRE signs)

Ask about specialized Marine or Real Estate apps.

[Return to Top]

July 2014 - If Your Wallet Disappears

NOW, before your wallet disappears, photocopy everything. Remember that the backs of your credit cards contain valuable information such as security codes and contact information. Note that you should not carry your Social Security card in your wallet.

If your wallet is lost or stolen:

- Change all your passwords.

- Call your credit card companies. Do not request them to "cancel" your account; instead ask for an "account number change." Cancelling your account can affect your credit score and cause problems if you have an outstanding balance.

- File a report with the police not only in the area in which your wallet disappeared, but also in your hometown.

- Contact the three major credit reporting agencies and ask them to put a fraud alert on your account: Experian; TransUnion; Equifax.

- Contact the Department of Motor Vehicles and ask them to put a note on your file.

- Notify your bank. You will need a new ATM or debit card and perhaps even a new checking account.

- Approximately two weeks after your wallet disappears, check your credit history. Visit AnnualCreditReport.com to obtain your free report. Recheck your credit report again after two to three months.

[Return to Top]

June 2014

- Without geometry, life is pointless.

- Alcohol and Calculus don't mix: NEVER drink and derive!

- You could make a pencil with erasers at both ends, but what would be the point?

- A teacher went to the optometrist before work. When he got there, he couldn't control his pupils.

- Did you hear about the soldier who survived both mustard gas and pepper spray? He's a seasoned veteran.

- A Buddhist to a hot dog vendor: "Make me One with everything."

- I'm reading a book about anti-gravity. I just can't put it down!

- I might push the envelope on occasion, but it's always stationary.

- I've been to the dentist so often now, I know the drill.

- Time flies like an arrow. Fruit flies like a banana.

- A boiled egg is hard to beat!

[Return to Top]

April 2014 - Statins: Can this help anyone you know?

UPDATE: 2022 - I'm still controlling my weight, staying active, and still not diabetic.

UPDATE: November 2014 - Apparently all statins (like real estate agents) are not created equal: Recent data seem to suggest that Lipitor is the statin most likely to increase the risk of diabetes while others, notably Pravachol, actually decrease the risk. Meanwhile, the lawyers on TV have started soliciting folks who might have acquired diabetes as a result of Lipitor. So stay tuned!

ORIGINAL POST:

In May of 2010 I was concerned with my blood A1C (a diabetes indicator), which had increased significantly since I started a small dose of Lipitor. (Lipitor is one of several similar drugs generally called statins which control cholesterol.) But a correlation does not automatically imply a causal relationship, so I put the idea in the back of my mind. A few months later I read a Consumer Reports Health article on a different topic that offhandedly made reference to the statins/diabetes link. In February 2011, I was declared diabetic. I felt as though I was starting to descend a slippery slope: Not a good feeling.

Rather than take diabetes pills, I decided to change my life! Never big on real soda, rice, bread, pasta, and potatoes; cutting out something I rarely ate was not a solution. I gradually decreased my Lipitor dose, increased my level and regularity of exercise, and dropped 5% of my body weight. By July 2011, my A1C was back to non-diabetic levels. In 2012, the FDA got on board, warning of the statin/diabetes risk. Statins can be valuable in controlling cholesterol, but users must be vigilant. My guess is that 15% of statin takers will develop an A1C problem. So if you are taking statins, monitor your A1C; you might not have to surrender to diabetes.

[Return to Top]

March 2014

- A vulture boards an airplane, carrying two dead raccoons. The stewardess looks at him and says, "I'm sorry, sir, only one carrion allowed per passenger."

- Two fish swim into a concrete wall. One turns to the other and says, "Dam!"

- Two Eskimos sitting in a kayak were chilly, so they lit a fire in the craft. Unsurprisingly it sank, proving once again that you can't have your kayak and heat it too.

- Two hydrogen atoms meet. One says, "I've lost my electron." The other says, "Are you sure?" The first replies "Yes, I'm positive."

- Did you hear about the Buddhist who refused Novocain during a root canal? His goal: transcend dental medication.

- A group of chess enthusiasts checked into a hotel and were standing in the lobby discussing their recent tournament victories. After about an hour, the manager came out of the office and asked them to disperse. "But why?" they asked, as they moved off. "Because," he said, "I can't stand chess-nuts boasting in an open foyer."

- Mahatma Gandhi, walked barefoot most of the time, which produced an impressive set of calluses on his feet. He also ate very little, which made him rather frail and, with his odd diet, he suffered from bad breath. This made him a super calloused fragile mystic hexed by halitosis.

[Return to Top]

February 2014 - Potpourri

Sharing a few things that you might use or enjoy...

- A quick link for Area Codes.

- A link for a free and fairly intuitive Photo Editor.

- I have done several of the Great Courses on DVD and find them very interesting. Click the link and if you do find something of interest, call in the evening and ask for Cindy. Tell her Captain David sent you.

- The Economist: As you likely know, I'm a writer, not a reader. But I was offered a free subscription to The Economist. It is is time consuming: I never read more than 10% of it; and its focus is not economics. It is a weekly world newspaper, and having British roots, it covers places I've never even heard of. The quality of journalism is exceptional in today's sea of hogwash. They offer a few free articles on-line if you "register." Give it a try Economist or get the real thing at the news stand.

[Return to Top]

December 2013 - Interesting, and perhaps even true

- Years ago in Scotland, a new game was invented. It was ruled "Gentlemen Only...Ladies Forbidden"...and thus the word GOLF entered into the English language.

- Coca-Cola was originally green.

- It is impossible to lick your elbow.

- The first novel ever written on a typewriter: Tom Sawyer.

- Each king in a deck of playing cards represents a great king:

- Spades - King David

- Hearts - Charlemagne

- Clubs - Alexander, the Great

- Diamonds - Julius Caesar - 111,111,111 x 111,111,111 = 12,345,678,987,654,321

- If a statue of a horse has both front legs in the air, the rider died in battle. If the horse has one front leg in the air the rider died as a result of wounds received in battle. If the horse has all four legs on the ground, the rider died of natural causes.

- Half of all Americans live within 50 miles of their birthplace.

- In English pubs, ale is ordered by pints and quarts. So in old England, when customers got unruly, the bartender would yell at them "Mind your pints and quarts, and settle down." It's where we get the phrase "mind your P's and Q's."

- At least 75% of people who read this will try to lick their elbow!

- See if you can read the message below:

I cdnuolt blveiee taht I cluod aulaclty uesdnatnrd waht I was rdanieg. The phaonmneal pweor of the hmuan mnid Aoccdrnig to rscheearch at Cmabrigde Uinervtisy, it deosn't mttaer in waht oredr the ltteers in a wrod are, the olny iprmoatnt tihng is taht the frist and lsat ltteer be in the rghit plae. The rset can be a taotl mses and you can sitll raed it wouthit a porbelm. Tihs is bcuseae the huamn mnid deos not raed ervey lteter by istlef, but the wrod as a wlohe. Amzanig huh?

[Return to Top]

November 2013 - Thoughts To Get You Through Any Crisis

- Indecision is the key to flexibility.

- Happiness is merely the remission of pain.

- Be careful! Accidents cause people.

- Nostalgia isn't what it used to be.

- The facts, although interesting, are irrelevant.

- Someone who thinks logically is a nice contrast to the real world.

- Things are more like today than they ever have been before.

- I have seen the truth and it makes no sense.

- If you can smile when things go wrong, you have someone in mind to blame.

- One-seventh of your life is spent on Monday.

- By the time you can make ends meet, they move the ends.

- Not one shred of evidence supports the notion that life is serious.

- Never wrestle with a pig: You both get dirty, but the pig likes it.

- The trouble with life is, you're halfway through it before you realize it's a do-it-yourself thing.

- This is as bad as it can get, but don't count on it.

- Expect the worst, you won't be disappointed.

- That which does not kill you makes you stronger.

[Return to Top]

September 2013 - Especially Helpful Windows Shortcuts

- Ctrl + A selects an entire document or window (A = all)

- Ctrl + C copies the selected item onto the clipboard

- Ctrl + F opens a find box

- Ctrl + X cuts the selected item and places it on the clipboard

- Ctrl + V pastes the clipboard item to the cursor's location

- Ctrl + Shift + Esc opens the Task Manager

- Ctrl + Esc opens the Start menu

- Esc cancels the current task (Esc = escape)

[Return to Top]

August 2013 - Investors Glossary

- Bull Market - A random market movement causing an investor to mistake himself for a financial genius.

- Momentum Investing - The art of buying high and selling low.

- Value Investing - The art of buying low and selling lower.

- P/E Ratio -The percentage of investors wetting their pants as the Market keeps crashing.

- "Buy, Buy" - A flight attendant making market recommendations as you step off the plane.

- Standard & Poor - Our life in a nutshell.

- Financial Planner - A guy who actually remembers his wallet when he runs to the 7-11.

- Market Correction - The day after you buy stocks.

- Cash Flow - The movement our money makes as it disappears down the toilet.

- Call Option - Something people used to do with a telephone in ancient times before email.

- Cisco - Sidekick of Pancho.

- Institutional Investor - Investor who's locked up in a nut house.

[Return to Top]

July 2013

If you have not tried on-line shopping, it's about time. You can find a wider selection of products at competitive prices without wasting your time visiting multiple stores. Be careful about shipping charges as well as clothing that might not fit. The following sites are very user-friendly with search functions that work well. I have been using them for years. Try...

Staples for office supplies. Their normal delivery is lightning fast. I have ordered one afternoon and had delivery the next morning, but normal is a day or 2.

McMaster-Carr for hardware supplies, especially hard to find or specialty items like weird-size furnace filters. They normally deliver in 2 or 3 days from New Jersey. These folks have been in business for at least 50 years.

For the widest variety imaginable, way more than just books, try Amazon. Give preference to items that are in-stock and ship from Amazon departments (fulfilled by Amazon) over items from smaller, loosely affiliated, third parties who might also appear on the site.

I have also had good experiences with Walmart.

[Return to Top]

June 2013 - Thoughts for Today

- I no longer need to punish, deceive, or compromise myself; unless I need to stay employed.

- A good scapegoat is as welcome as a solution to the problem.

- As I let go of my feelings of guilt I can get in touch with my Inner Sociopath.

- I have the power to channel my imagination into ever soaring levels of suspicion and paranoia.

- I will gladly share my experience and advice, for there are no sweeter words than "I told you so."

- I need not suffer in silence while I can still moan, whimper, and complain.

- I honor my personality flaws, for without them I would have no personality at all.

- Joan of Arc heard voices too.

- When someone hurts me, forgiveness is cheaper than a lawsuit, but not nearly as gratifying.

- Why should I waste my time reliving the past when I can spend it worrying about the future?

- I am willing to make the mistakes if someone else is willing to learn from them.

[Return to Top]

April 2013

The internet connection Speed Test.

[Return to Top]

March 2013

Link to the Washington Post article about my friend Michael. His work at Saint Catherine's Monastery follows his work helping to uncover the secrets of the Archimedes Palimpsest.

[Return to Top]

February 2013 - Interesting Quotes

- "What I need is an exact list of specific unknown problems we might encounter." (Lykes Lines Shipping)

- "E-mail is not to be used to pass on information or data. It should be used only for company business." (Accounting manager, Electric Boat Company)

- "This project is so important, we can't let things that are more important interfere with it." (Advertising/Marketing manager, United Parcel Service)

- "Doing it right is no excuse for not meeting the schedule." (Plant manager, Delco Corporation)

- "No one will believe you solved this problem in one day! We've been working on it for months. Now, go act busy for a few weeks and I'll let you know when it's time to tell them." (R&D supervisor, Minnesota Mining and Manufacturing/3M Corp.)

- Quote from the Boss: "Teamwork is a lot of people doing what I say." (Marketing executive, Citrix Corporation)

- "We know that communication is a problem, but the company is not going to discuss it with the employees." (Switching supervisor, AT&T Long Lines Division)

- One day my Boss asked me to submit a status report to him concerning a project I was working on. I asked him if tomorrow would be soon enough. He said, "If I wanted it tomorrow, I would have asked for it tomorrow!" (New business manager, Hallmark Greeting Cards)

* * * * * * *

AFiRE — Licensed broker in Florida and Virginia

A Friend in Real Estate, LLC

* Copyright © David Rathgeber *

* * All rights reserved. * *