David Rathgeber's

Charts & Statistics

Introduction

This is an in-depth analyses of real estate statistics, how they are developed, what they mean, and how they should, and should not, be used. Too often we see and hear real estate information that sounds important, but is patently useless. It is hoped that buyers and sellers of resale homes can use this information to see through the fog and to confirm their ability to discern what constitutes actionable information. You will not see this anywhere else!

Also see What are they talking about?

This page contains the following sections:

- Comparing data

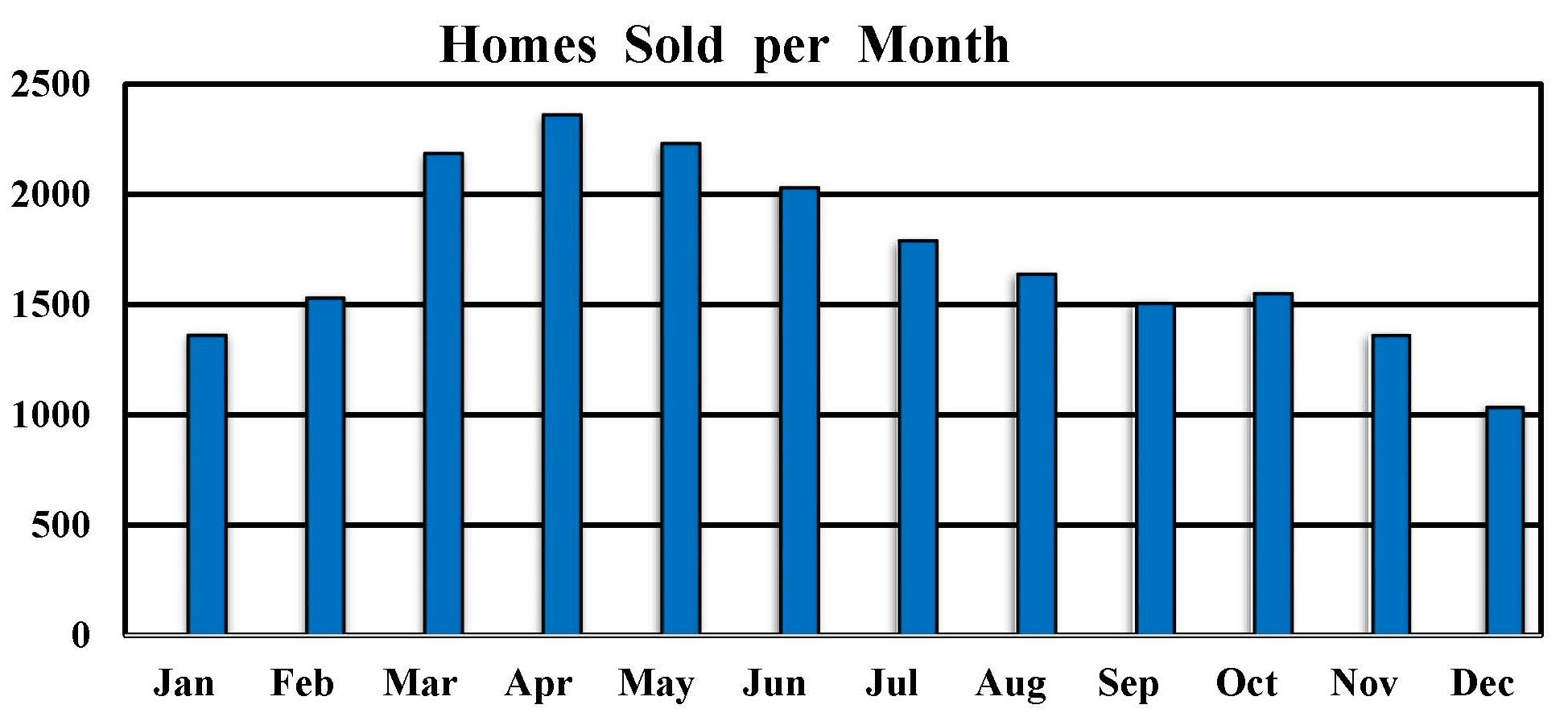

- Demand for homes (with chart)

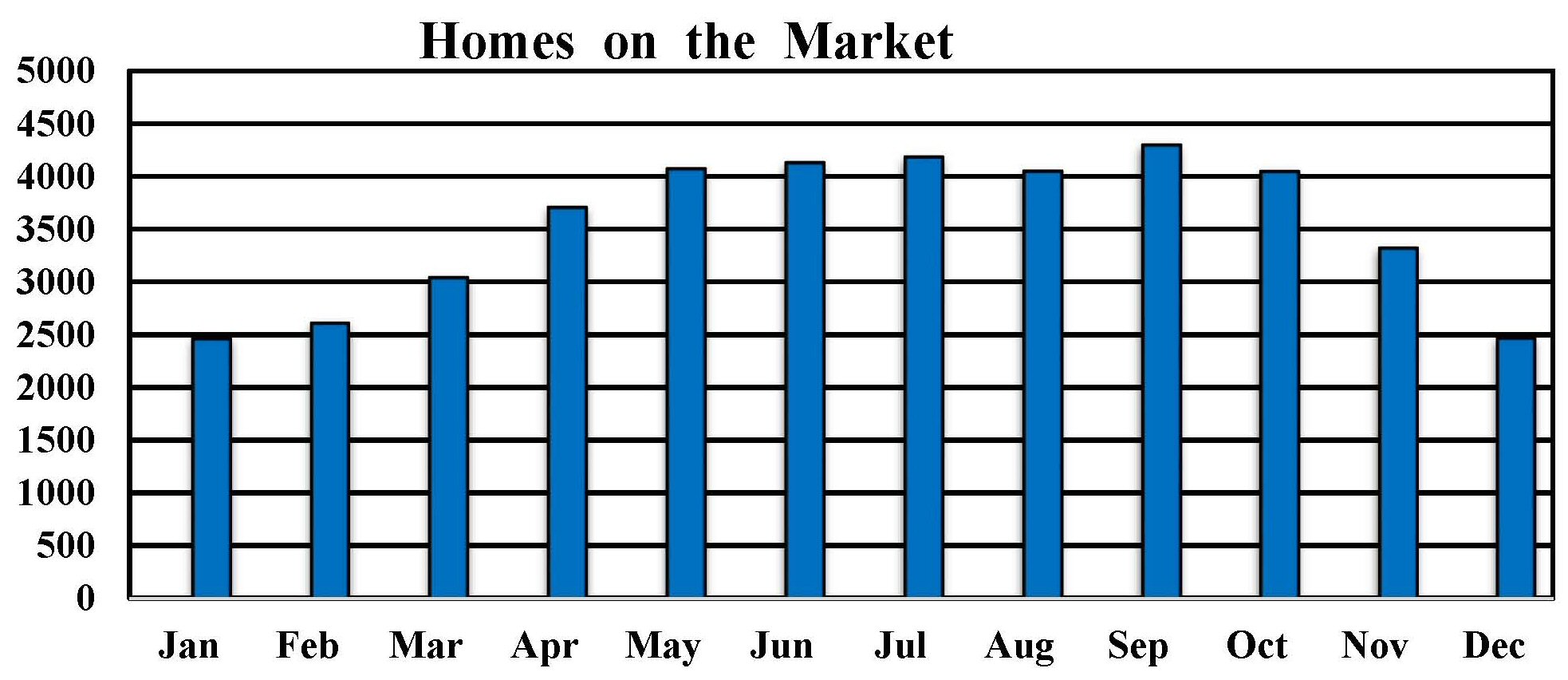

- Supply of homes (with chart)

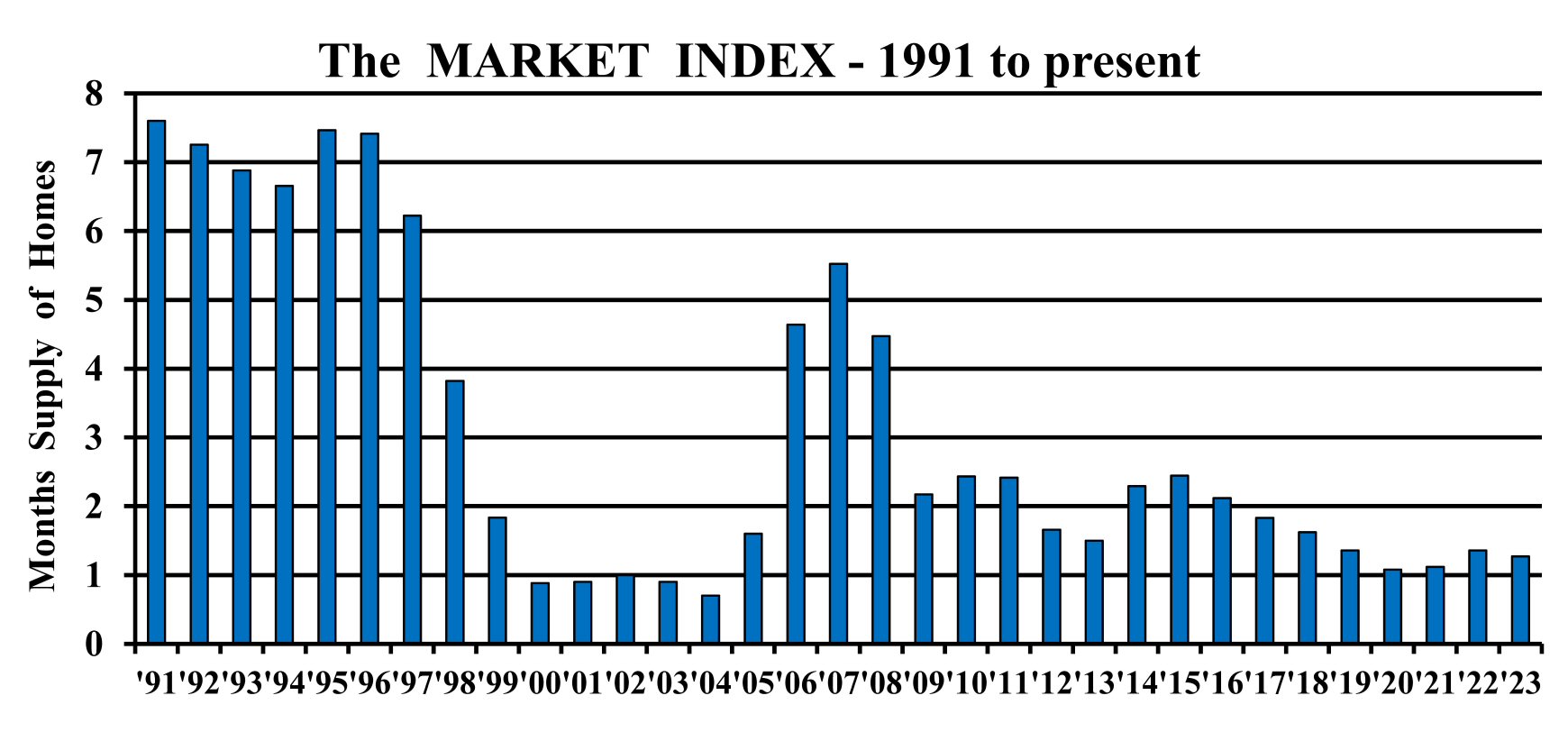

- Market Strength (with chart)

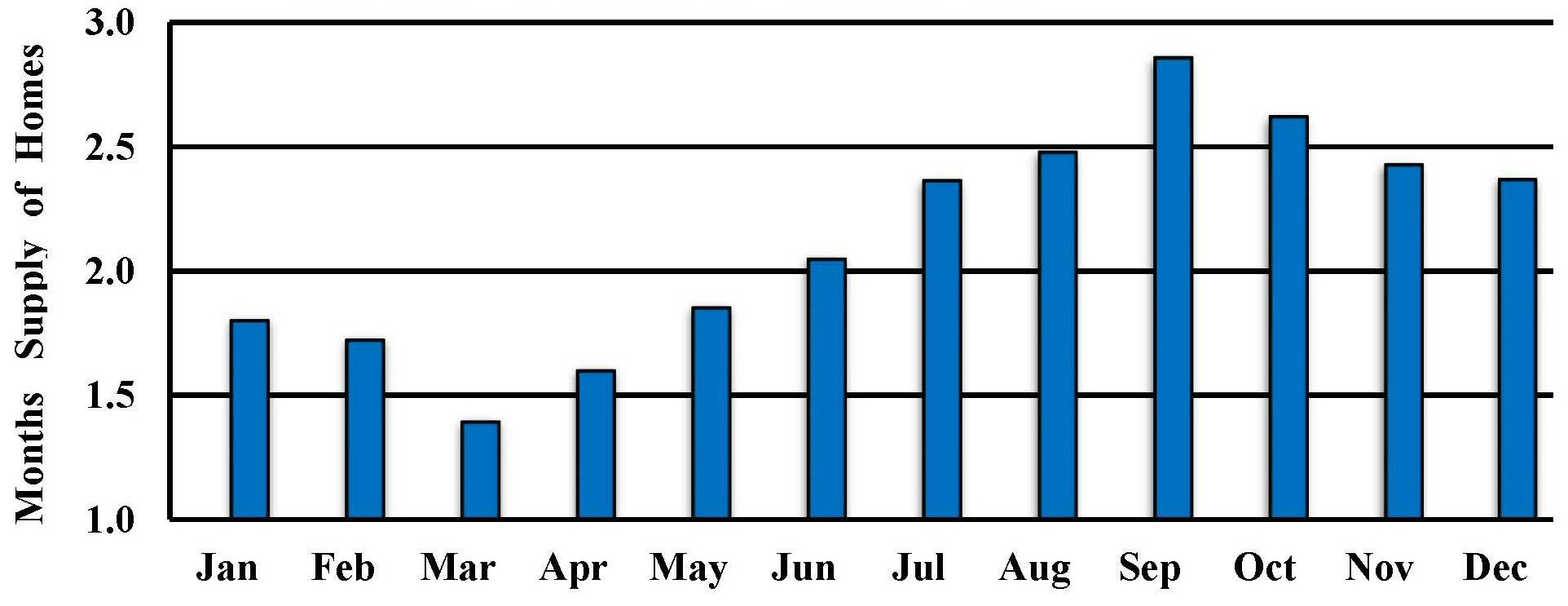

- Market Seasonality (with charts)

- Short-Sales: A disturbing influence

- Market Prices (with chart)

- Statistical Significance

- Days on the Market (with chart)

- Days on the Market versus Asking Price (with chart)

- Showing Traffic

- Selling-Price to Asking-Price Ratio (with chart)

- Vacant Homes (with chart)

- Dollars per Square Foot

- Tax Assessments

- Interest Rates

- Housing Affordability Index

- New Home Data

- Average vs. Median

- Methodology

Comparing data

First consider the source. It is safer to assume that data from one reporting source cannot be compared to that from another. Next, be sure of what area is being reported. There are significant regional variations even within our own metropolitan area. In short: Compare apples to apples.

Our real estate market is seasonal. As data is generally reported in monthly increments, 2 comparisons make sense:

- Comparing recent data to the same month last year.

- Comparing recent data to data from the previous month.

The first comparison tends to remove seasonality and provides a long-term view. The second comparison tends to include seasonality and provides a short-term view. However, they are both comparisons of 2 bits of data. If the individual monthly data points (e.g. averages) contain a lot of noise or bounce, the resulting comparison is subject to the same inaccuracy.

Always check to see whether the data is recent, or several months old. Some data reported in the media is 6 months old and is therefore useless. From what perspective is the data analyzed? For longer-term data; how were the start and end dates selected? For example, we get very different views if we calculate home price appreciation to date starting in 1990 versus starting in 1998, 2006, or 2009!

Why was the data analyzed? The methodology will influence its usefulness. Was it prepared to help:

- Investors in the stock market?

- Macro-economists predict the future?

- Media folks fill some column space?

- Radio or TV folks prepare a sound bite?

- Home buyers and sellers (that's you)?

Massaging the data is a bit more complex than it seems on the surface. How it is done can matter and big mistakes are made. If you are looking for actionable information, you need to be sure.

Try to determine what is included in the data. Is the data for resale homes? Is it diluted by inclusion of:

- Rentals?

- New homes?

- Commercial properties?

- Re-finance appraisals?

Is it limited by inclusion of only:

- Repeat transactions?

- Single family homes?

- Distress-free properties?

- Sales with certain types of loans (for example, conventional)?

- Sales with loans lower than a given amount (for example, "conforming" loans only)?

Does the data include short-sales, and what is the effect? Is it seasonally adjusted? Is it inflation adjusted? All of the above are complicating factors in the assembling of data that we hear frequently. But no one takes the time to explain them to us, and they can make a significant difference, especially in the approximation of average home prices where the number of data points controls the accuracy of the result. As a buyer or seller of a resale home, this is very important to you and, sadly, these are distinctions often lost on the folks collecting, massaging, and reporting the data.

And finally, we are a regional market; there is no national real estate market. While national averages are important for macro-economists they are merely useless bits of information for individual homeowners.

Also see the comments on Statistical Significance.

[Click here to return to top]

Demand

Demand alone is of almost no importance to home buyers and home sellers. Without supply, it is only one side of the story. It generally need not be reported as it would only serve to dilute any main message.

Demand alone is of almost no importance to home buyers and home sellers. Without supply, it is only one side of the story. It generally need not be reported as it would only serve to dilute any main message.

However, note that peak sales occur in April, not the summer "when the kids are out of school" as you might have been told. The graph above is based on contracts entered, not sales closed. Buyers, sellers, and agents need to know about contract activity. They could care less when, or even if, the sales go to settlement. Further, those interested in demand should realize that it not only fluctuates seasonally, but also varies with macro-economic trends on a 15 to 20 year cycle, in recent decades.

Note to Realtors: Demand is of critical importance to you. There can be significant, periodic, and sometimes random fluctuations in one's own business volume. So be sure to bury some acorns in the boom times to provide for the times when the seasonal, macro-economic, and personal cycles hit a concurrent low. Remember that the alternative is getting a real job. Ugh!

[Click here to return to top]

Supply

Supply alone is of almost no importance to home buyers and home sellers. Without demand, it is only one side of the story. It generally need not be reported as it would only serve to dilute any main message, but do notice how little supply varies from May to October. This is discussed later under Market Seasonality.

Supply alone is of almost no importance to home buyers and home sellers. Without demand, it is only one side of the story. It generally need not be reported as it would only serve to dilute any main message, but do notice how little supply varies from May to October. This is discussed later under Market Seasonality.

However, the percentage of foreclosures, short-sales, and vacant homes compared to all homes on the market can sometimes be of importance. They should be reported when they have the potential to affect buyers, sellers, or average home prices. Lower percentages of distressed properties are better for sellers. Higher percentages are better for buyers, because distressed properties imply market softness and can apply downward pressure on prices.

[Click here to return to top]

Market Strength

The single most important real estate statistic is the Months Supply of homes on the market shown above. A number greater than 5.0 indicates that buyers have the upper hand. A number lower than 3.0 favors sellers, and less than 1.5 indicates a hot market.

The single most important real estate statistic is the Months Supply of homes on the market shown above. A number greater than 5.0 indicates that buyers have the upper hand. A number lower than 3.0 favors sellers, and less than 1.5 indicates a hot market.

To obtain this figure, the number of homes on the market is divided by the number of contracts entered (sometimes called pending sales) for the previous month. The focus is on resale homes: Rental properties and brand new homes are excluded from the calculation.

Home sellers can use the information as a measure of:

- how to price their home

- how long their home might be on the market

- what pace is best when negotiating an offer

- how likely they are to obtain two or more concurrent offers.

Home buyers can use the information as a measure of:

- how soon they need to view homes new on the market

- how long they can "think about" a property of interest

- the likelihood of other offers appearing during negotiations.

Months Supply is the most important statistic because it incorporates both supply, demand, and the effects of home prices, interest rates, and local economic conditions into a single real-time indicator. A monthly reading can be immediately available with essentially no delay or distortion by using the number of contracts entered, that is pending sales, not closed sales. Nearly all pending sales proceed to closing. More importantly, pending sales represent actual contracts; whether they close or not is irrelevant.

One way to view the Months Supply of Homes: With a 4 Months Supply, if buyers kept buying at the current rate and no new homes entered the market, after 4 months there would be no homes left on the market. Of course this never happens, but merely serves to illustrate the concept.

There is a distinct seasonality (see the section below) to the real estate market, which is reflected in the Months Supply. This means that certain times of the year are somewhat more advantageous for home sellers (March) and other times are more advantageous for home buyers (September). You cannot beat timeliness coupled with accuracy!

Note: The inverse of Months Supply is sometimes reported as the Absorption Rate. For example, a 3 Months Supply is the same as a 25% Absorption Rate.

[Click here to return to top]

Market Seasonality

The graph below incorporates supply and demand into a single number for each month and shows the seasonality of our real estate market in recent years. Sellers still have their best market in March, not June and July as you often hear. But buyers now do best in September; not December anymore. This is the new normal.

What has changed? The seasonal pattern and shape of the demand (number of homes sold) chart has not changed with peak sales usually occurring in April. The seasonal pattern and shape of the supply (homes on the market) chart has flattened. There is now very little change in supply from May to October, and the average number of days on the market is much lower than years ago. Both supply and demand are decreasing in the final months of the year as always, but the supply decrease has become the controlling factor.

[Click here to return to top]

Short-Sales: A disturbing influence

Short-sales had a disturbing influence on market data for a few years. While foreclosures and vacant homes generally are sold and closed in relatively normal time frames, short-sales can take much longer. Many buyers will not even view them, so they languish on the market. Therefore, including them in homes on the market increases Months Supply figures un-naturally. In other words, they look like inventory but really are not. Excluding them altogether from the calculation would also be misleading because they are of interest to a limited number of buyers.

Further, a significant proportion of short-sale contracts never get to closing, which results in more than one contract per property. As buyers get discouraged and bail out, it makes way for second, third, and more successive contracts (not to be confused with multiple offers) on the same property. While this tends to offset the effect of inflated inventory described above, there is no telling to what extent this happens.

Fortunately, lenders (with government urging) have improved their ability to deal with short sales. Further, the number of short-sales has declined significantly since 2008. At this point, the disturbing influence on our data is negligible.

[Click here to return to top]

Market Prices

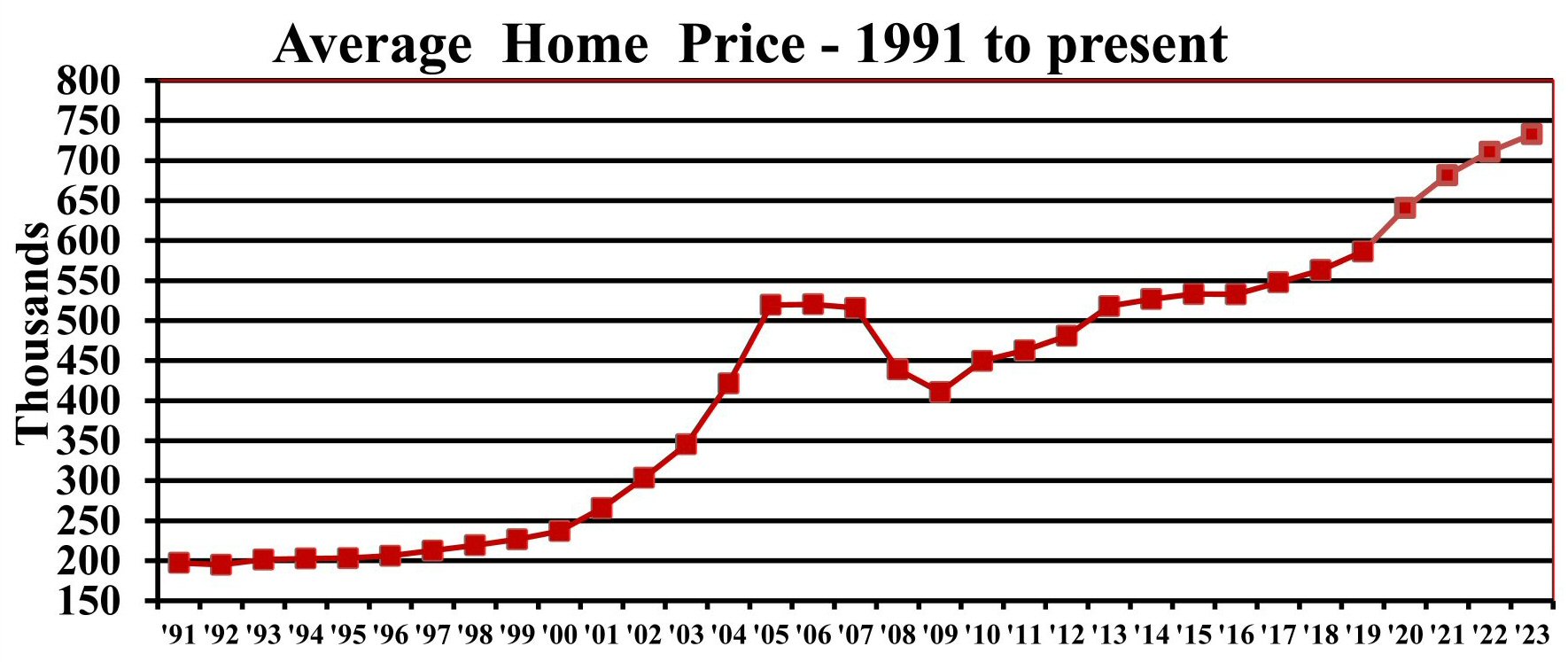

The graph above displays the Average Home Price trend for our area from 1991 to date. Note the unusually slow market of the early 1990's when home appreciation was nil for 6 or 7 years. Then the market heated up dramatically until the average price peaked at $568,074 in June 2006 then started to decline, hitting a low of $359,660 in December of 2008.

Our ears always perk up when we hear home price data, but the information is generally recreational rather than actionable. The average home price can rise or fall in two ways:

- Due to general appreciation or depreciation of all homes, including yours. This is what we assume when we hear the data.

- But the average home price can also change even if individual home values do not. How is this possible? Simply, if the distribution (or the mix) of sold homes changes, for example, by a higher proportion of expensive homes being sold.

When we try to distinguish between these two effects by looking at the medians instead of average prices, we find that the medians and averages generally rise and fall together. So this seems to be of no help. Nevertheless, if a trend is indicated, and it has resulted from general appreciation or depreciation, it can be valuable in the following ways:

For home sellers:

- If prices have been increasing, sellers might elect to not reduce their overpriced listing that is getting too few showings, and wait for prices to rise to their level.

- If prices have been decreasing, sellers will need to reduce their overpriced listing by a rate greater than that of the market declines in order to ever sell.

For home buyers:

- If prices have been increasing, buyers might be willing to pay several percent above the asking price for a home if required, with the reasonable expectation that in a few months they will recoup their "loss" and forget their indiscretion.

- If prices have been decreasing, buyers will have no sense of urgency because they can expect greater value for their money in the future.

Note that a price calculation can be done for homes currently on the market or for only those homes that have recently sold. The on the market calculation yields average prices much greater than the average for recently sold homes. But the numbers generally quoted in the media are for sold homes, so buyers and sellers who are contemplating action need to remember that this is old news. How old is it? It is 2 to 4 months old: Two unavoidable months old due to data collection limitations (the lag between contract and closing) and another month or two for data assembly, review, comment, and publication. It is critical to understand this, because taking action on 2 to 4 month old data can be a disaster. To compound the problem, the media generally reports the data as "last month's numbers" since an explanation such as that above is much too time consuming.

The concept of statistical significance is germane to this discussion as many of the average prices reports are worse than meaningless; they are misleading. Be sure to see the segment entitled Statistical Significance.

[Click here to return to top]

Statistical Significance

Statistical Significance is a mathematical concept, too infrequently applied to real estate data. It states that in order for a conclusion to be meaningful, it must be based on a sufficient number of observations or individual data points. A complete treatment of the subject is far beyond the scope of this author, but the concept is important: Depending on the set of data being analyzed, there is a certain minimum number of individual data points required in order for the conclusion to be reliable, valid, or useful. Inaccuracy due to an insufficient number of data points is sometimes called "statistical bounce." Such inaccuracy exists in most published reports of average home prices, often to an alarming extent.

Of course, there is a reliable statistic called average home price which changes over time in some orderly fashion (i.e. without excessive noise or bounce). The intent of an average price calculation is to measure the change in price for all homes in a specific area by calculating an average of those homes that have sold recently. In other words we are trying to measure an entire population with data from a small portion of that population.

An empirical analysis was performed on a 3 month sample of Northern Virginia sold homes. There were nearly 10,000 data points (sold homes) in the sample; enough to provide a reliable average. When random samples roughly representing one month (3,300 solds) were analyzed, the average price was found to be within 4% of the correct value about half the time. When random samples of 20 solds were analyzed, the average price was found to be within 10.6% of the correct value about half the time.

To summarize, an average of 10,000 solds results in a reasonable confidence level (i.e. accuracy) for an average price calculation in order to provide valuable, actionable information. As few as 3,300 solds (roughly one month of Northern Virginia solds) can be useful if viewed with skepticism: When the average Northern Virginia home price usually changes less than 1% in any month, a monthly number that can be 4% off is worthy of skepticism! So when you see published data that bounces around from one report to the next, you will understand why.

For example, an average price can be calculated for any zip code you wish, but to get to 10,000 solds would take years and years of data, so any accurate reading would be based on data which is, on the average, many years old; again, meaningless. This is why average home prices in any zip code for any month, or even a year, are patently meaningless: The data sample size is not large enough over a short enough time. Nevertheless, we often hear average price calculations which are based on less than 20 data points! Many media folks have no concept of statistical significance and will report anything that sounds like news, useful or not. The fact that someone found some numbers and calculated an average might be good enough for them, but not for savvy folks like us.

[Click here to return to top]

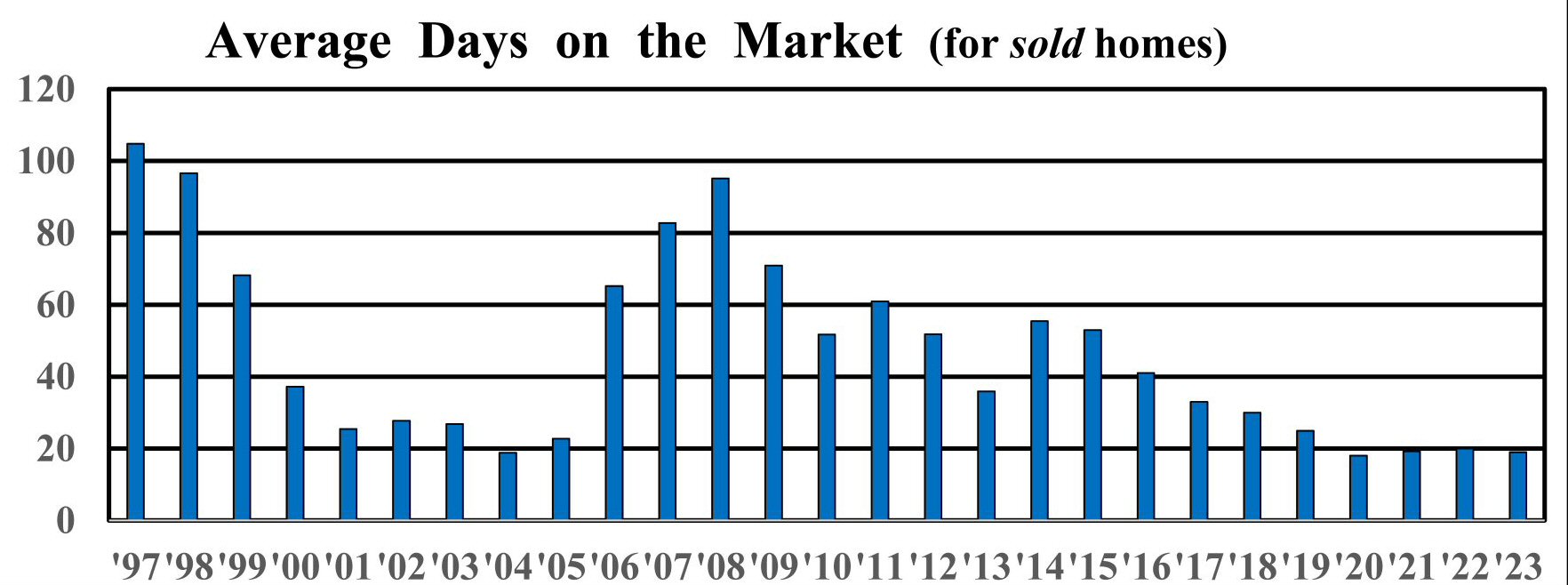

Days on the Market - DOM

DOM should be an important statistic, but the interpretation is too tricky: The calculation can be done for all homes on the market, or for only those homes that have sold recently. In the latter case, days to agreement, days to removal of contingencies, or days to closing might be the figure that gets reported. To further compound the problem, some MLS systems compute DOM using only the current listing of a home, some account for previous un-sold listing entries of the same home, some systems provide both figures, and some provide no information at all.

To add still another level of problem-compounding-complexity: The most useful, DOM at the current price, is often difficult or impossible to determine. And finally, at the risk of TMI, no one ever tells you which number they are reporting! To be useful, DOM should be calculated as days to agreement, at the final price, for recently sold homes. The MLS computer-weenies all know how to calculate an average, but none of them know or even care whether it is useful to anyone.

Using DOM in an ideal world for home sellers:

- DOM for all homes currently on the market including previous listings thereof can be doubled and used by a seller as a worst-case scenario for planning purposes.

- The number of days it took to sell half the homes that have recently sold (i.e. the median) can be used to indicate the time when a seller should start to consider a price reduction.

When the market speaks, sellers need to listen, but remember that any sold data lags by 1 or 2 months, plus the time needed for data assembly and publication.

Using DOM in an ideal world for home buyers:

- If buyers hear a high number, some will assume they can postpone action; but many find that needless delays are extremely unwise.

- In delaying action buyers are "playing with fire" due to the extreme variability of results and the propensity of other buyers to pop up at the wrong time and buy their home of choice.

Due to the complications noted above, published DOM should never be used by home buyers or sellers. Comparing same-source figures from last month or last year might indicate which direction the market is headed, but better indicators are available.

Important note for home buyers: Delays normally favor home sellers, so never delay a decision or the negotiation unless absolutely necessary. The risk is having to live forever in your second-choice home. Further, when considering buying a home, don't ask how many days it has been on the market. Ask how many days it has been on the market at the current price.

[Click here to return to top]

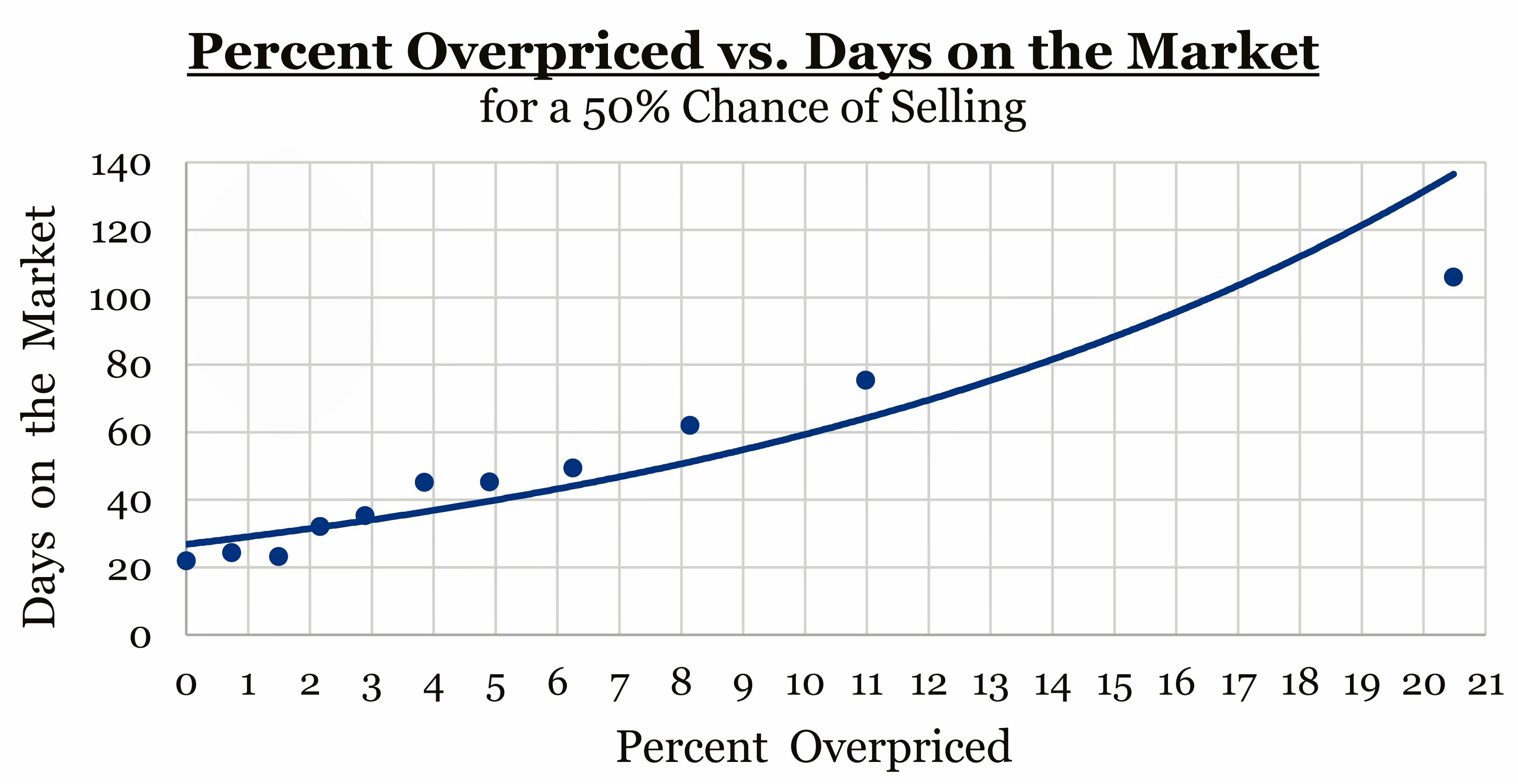

Days on the Market versus Asking Price

The graph below illustrates the relationship between a home's time on the market and its asking price, using 2023 Northern Virginia data. When a home is 5% overpriced, it's a full level of perspicacity out of touch with the market. The home will be shown to the wrong buyers: Those who really want and can afford a better home. It will not be shown to the proper set buyers because they think they can't afford it.

Note: When a home goes on the market, no one knows its exact market value. (No, not even Zillow, or the tax assessor!) When setting an asking price, after a careful analysis, check whether average prices are rising or falling annually as well as seasonally, and always check the all-important months supply.

[Click here to return to top]

Showing Traffic

The very best market indicator for home sellers is the number of showings your home receives every week. Reasonable expectations vary greatly by the health of the market, seasonality, price range, and proximity to the geographic center of your region's market. But if no one came to see your home in the last 2 weeks you very likely are in trouble: The answer is most likely on the sheet that comes out of the printer from the MLS. Often, but not always, it is your home's asking price. This is not rocket science, just attention to details, which includes knowing which details need attention. There is no magic involved in selling a home.

[Click here to return to top]

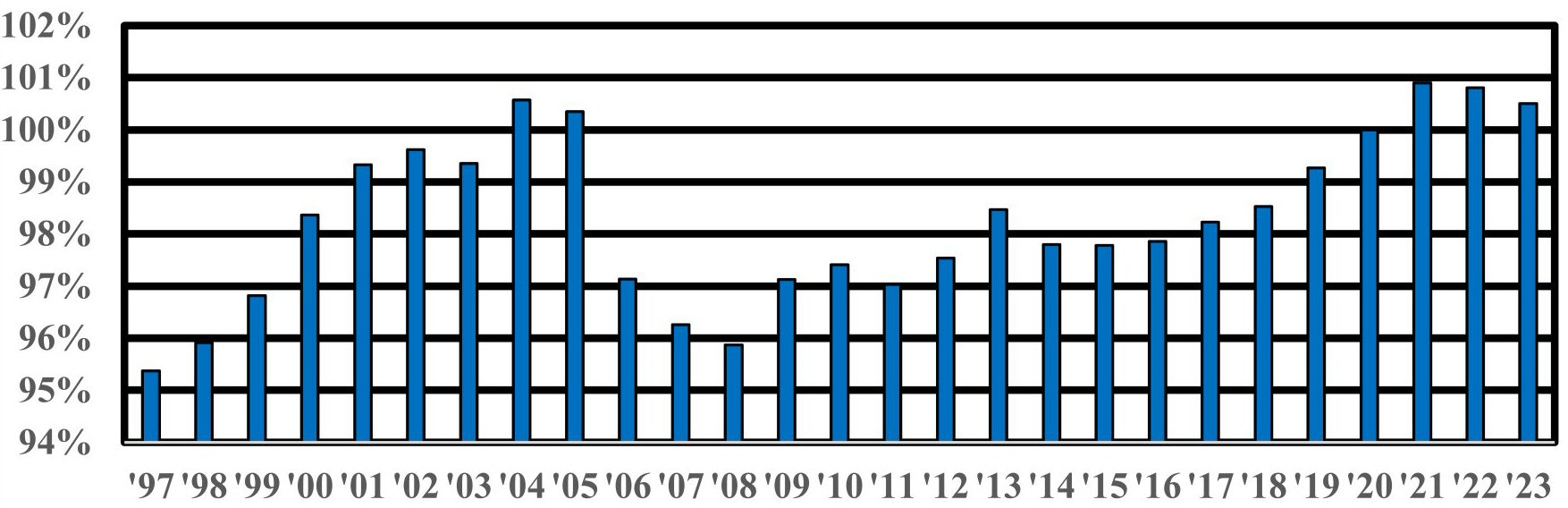

Selling-Price to Asking-Price Ratio

The selling-price to asking-price ratio, expressed as a percentage, is one of the most important statistics available. For a buyer, it provides an indication of how much can be negotiated off the average asking price so that expectations are kept within a reasonable range, and so that time is not wasted viewing properties that are priced out of reach. For a seller, the ratio tells how much "fat" is required in the asking-price. Sellers and buyers alike are surprised to find the ratio is so high, almost always greater than 95%. In fact, in a hot market, the ratio averages over 100%!

To set the expectations of buyers making an offer when there are no other buyers, it will be helpful to calculate an average of only the transactions for which the ratio is less than 100%. A similar calculation of only the transactions for which the ratio is greater than 100% is useful information for buyers in multiple-offer situations.

To calculate the selling-price to asking-price ratio, select recently sold homes from the MLS database. Divide the total of all the selling prices (reduced by any seller credits) by the total of all the asking prices to find the selling-price to asking-price ratio. It is important to include at least 200 individual sales to ensure an accurate result. The selling-price to asking-price ratio represents critical information about our market; do not rely on a guess or the 95% figure noted above. Obtain an exact, up to date reading, tailored to your needs.

One might also use the selling-price to asking-price ratio as a measure of an agent's negotiating performance: Compare an individual's record with the local average. Wow!

[Click here to return to top]

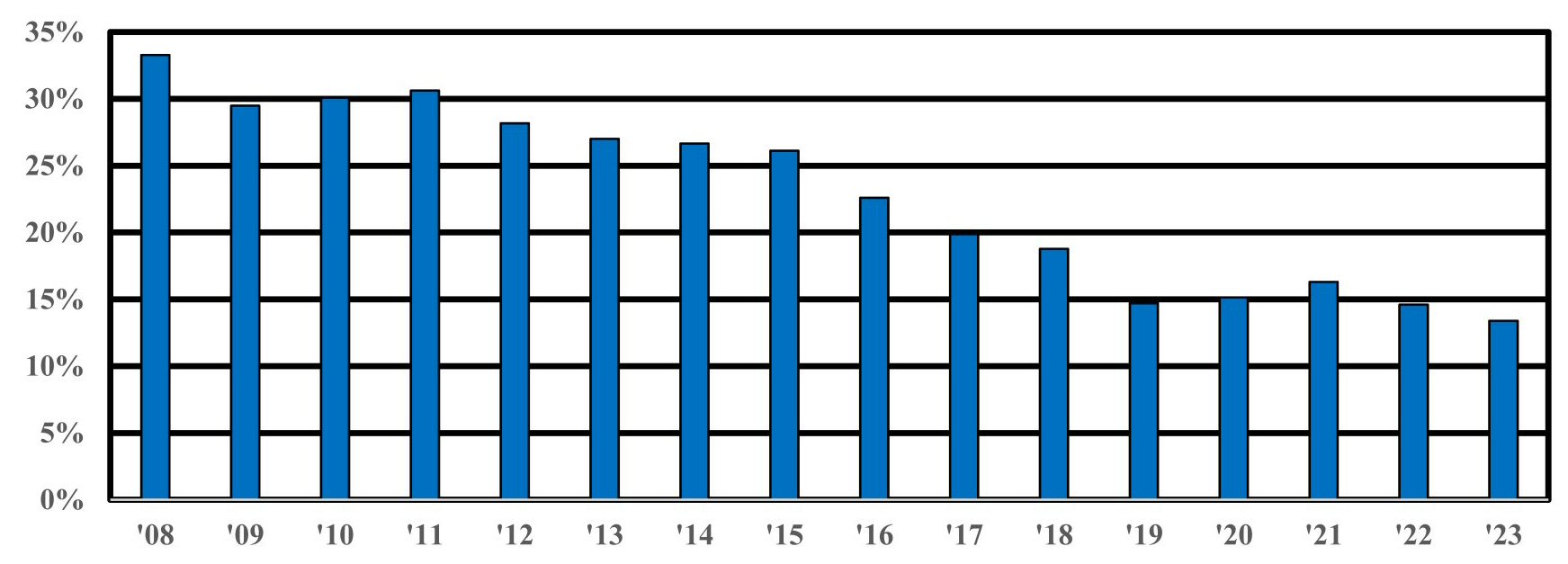

Vacant Homes

The graph above shows the percentage of vacant homes for sale in Northern Virginia. It has been decreasing in recent years. This reinforces the notion of a strong market, as indicated by low Months Supply and low Days on the Market figures. Vacant homes for sale will increase with the number of job-related moves and foreclosures. It will also increase when folks are able to move into new quarters without first selling their current home.

[Click here to return to top]

Dollars per Square Foot

(what you need to know)

Yes, size matters, but here's a word of caution: The calculation of dollars per square foot is likely included by your MLS system. It is an easy concept to grasp but is often misused. While dollars per square foot provides important insight, misuse of the data is one reason your tax assessed value and Zestimate can be off by 30%, and that’s a lot. Some MLS systems make no mention of this figure in order to minimize the inherent dangers.

Figures quoted are always for an average square foot. But a little-known concept (unless you’re an appraiser) is the value of a marginal (or additional) square foot. It is easy to understand that an extra 100 square feet added to a 300 square foot home is of great value. On the other hand, an extra 100 square feet added to a 5,000 square foot home is worth much less.

The value of an average square foot is often $300 to $500. But State-licensed appraisers, who adjust for marginal square feet, are currently using a value of about $100 to $200! Remember, there are many important factors other than size that determine property values.

[Click here to return to top]

Tax Assessments and other schemes

A tax assessment is the value a local government assigns to a home for real estate taxation purposes. It has only a very general relationship to that home's market value: It is so general as to be useless. But some will tell you there is a direct relationship. They have not done an analysis, are relying on a very few bits of data, or are repeating "what everybody knows." A careful analysis of the statistics proves them wrong, both over a wide area as well as in an area as limited as a development or subdivision.

One who attempts to predict a market value or contract price from a tax assessment needs to guess a percentage factor to multiply by the tax assessment to obtain the predicted contract price. That would mean correctly guessing a number (the percentage factor) with absolutely no basis for making the choice. Of course, there is some average relationship between tax assessments and market values that can be calculated. But use of an average figure to determine the market value of a specific property should be enough to make even the tax assessor giggle.

Amazingly, elaborate calculation schemes or algorithms (pronounced: Al Gore rhythms) have been devised to predict a market value from tax assessments. Although the mathematics are impeccable and some such schemes have even gotten favorable press nationally, the fact remains that when you do any calculation using basically flawed data, the result is inevitably flawed. Garbage in; garbage out. End of story.

Be alert to anyone who tries to draw a conclusion from just a few cases: This is logically as well as mathematically unsound. Also reflect on how long it has been since the tax assessor even visited your home. Never?

Zillow, and other such schemes that rely heavily on tax assessments, are just as inaccurate. Track down Zillow's own disclaimer: For our area, they report they are within 10% of actual market value 69% of the time. That means they are more than 10% off almost one-third of the time.

There is no substitute for a properly prepared market value analysis or an appraisal. Mortgage lenders do not rely on tax assessments, and neither should you. In short: The market price of a home is defined by the price paid by a buyer to a seller, neither being under duress, etcetera, etcetera. Anything else is an estimate, and some of them are way off!

[Click here to return to top]

Interest Rates

Interest rates are an important factor in a real estate transaction. Familiar to all, they do not need much explaining: Lower is better for everyone. It is striking to calculate that at the very same monthly payment, one can buy 50% more home at a 4% interest rate compared to 6%!

Whether you are a buyer or a seller, keep an eye on changes in interest rates. They can have an important effect on the real estate market, but changes sometimes can have the opposite effect from that reasonably expected: A sudden increase can sometimes trigger buying activity, albeit temporary.

Also, real estate markets do not always move in lock-step with mortgage rates: There is often a time lag between interest rate changes and changes in market activity. Finally, the great differences in home price appreciation and depreciation in different markets across the country are indeed notable, even though mortgage rates are nearly uniform. This suggests that the rate itself is a less important factor than precipitous changes in rates.

[Click here to return to top]

Housing Affordability Index

Consider the interrelationship between interest rates, home prices, and personal income, or purchasing power. When one of these factors experiences a significant change, one or more of the other factors will also be affected. Mortgage interest rates can make significant moves in a short time. Personal income depends upon employment as well as wage and salary levels and therefore it moves more slowly. But personal income and interest rates change independently of each other and are influenced by macro-economic trends. Home prices are caught in the middle as the dependent variable.

For example, if mortgage interest rates move down this means improved affordability for real estate. Even if personal income remains stable, buyers can buy much more for the same monthly payment that they were undertaking previously. This results in upward pressure on home prices. But as we know, home prices do not move (inversely) in lock-step with mortgage rates. Home prices can be held in check by economic worries, a large resale home inventory, or economic malaise. On the other hand, they can increase quickly in hot markets without any change in mortgage interest rates.

So the housing affordability index is not fixed, but varies greatly with time and location. Examination of affordability in various markets across the US presents quite a diverse picture. What do you think the housing affordability index is in Honolulu? Hong Kong? Tokyo? London? Get the idea? The Index is an interesting but useless piece of data for home buyers and sellers. Further, it is way beyond our control.

So what is important? You have all the information you need to determine your own personal home affordability. An Index helps fill a news spot, but it is meaningless for you.

[Click here to return to top]

New Home Data

New homes account for roughly 10% of home sales, but the actual volume can expand or contract radically due to changing economic conditions. For you economist buffs, this is called elasticity of supply. Reliable data for this market segment is available from the National Association of Home Builders (NAHB). For the individual home seller, zero new home construction would be ideal. For buyers, the more, the merrier.

While most home buyers consider new homes as well as resale homes, individual home sellers need to be especially vigilant when considering their marketing strategy if comparable new homes are available nearby. National and regional data reported by the media include new home sales, housing starts, permits issued, etc. But new home construction is neither controllable by, nor significant for most buyers and sellers. It's just a "blip" on the curve.

[Click here to return to top]

Average vs. Median

Both average and median values can be calculated for almost any set of data, including, home prices, days on the market, and selling-price to asking-price ratio. Since both average and median values tend to rise and fall in unison, it seems needless to report both. It is suggested that only the average values need be reported, because the concept of an average needs no explanation.

It should be noted that median values for home prices and days on the market are generally lower than the averages for those data sets. For you statistics buffs, this is due to the skewness of the data. Median values for selling-price to asking-price ratio are usually higher than the averages, but sometimes the opposite is true. Such a reversal is most likely in an especially hot spring market, no doubt due to a reversal of the skewness.

There is another statistical measure called the mode. While it might be useful in some cases, it requires too much explanation for the casual reader. We therefore suggest that it not be considered, unless preceded by "pie ala-."

[Click here to return to top]

Methodology

Data is collected from the Realtors' MLS system in the morning on the 1st day of every month. The most important statistic is the Months Supply of homes on the market. To obtain this, the number of homes on the market is divided by the number of contracts that were entered in the previous month (sometimes called "pending sales"). The Report's focus is resale homes: Rental properties and new homes are excluded from the calculations as both are very different markets. Separate data are collected for detached homes, townhomes, and condominiums and for various geographical areas.

Over the years, some very interesting facts have been uncovered. The most important of these is that the best month for home sellers is March, not June to August as the others keep telling us. What they are saying sounds right, but the data prove otherwise.

Home buyers and sellers need the very best and most timely information anywhere. But many market reports are two to six months out-of-date because they are based on closings, not contracts entered and are generally not published in a timely manner. Some reports may be distorted by rental, and new home information. Further, some sources calculate Months Supply including pending sales along with homes on the market in the numerator of the fraction. This distorts the calculation since most agents and buyers consider that pending sales are not fully available and do not view them.

One government report on average home prices is heavily based on re-finance appraisers' opinions which clearly are not pertinent, and another widely quoted measure of prices employs an algorithm so arcane as to make its data useless! Finally, it bears repeating (again and again) that although data can be collected and averages can be calculated, there is no national real estate market. To know what is happening in our area, we must use data only from our area.

[Click here to return to top]

* * * * * * *

YFiRE

Your Friend in Real Estate, LLC

Licensed broker in Virginia and Florida

* Copyright © David Rathgeber *

* * All rights reserved. * *