This is the MOBILE Friendly site // David's Main website

Buying Your First Home

Presented in person at George Mason University's

Arlington campus, as well as virtually in 2022.

This analytical talk covers the entire buying process tailored for first-time buyers in today's hot market. David will share 3 decades of experience and provide important how-to information. Unique ideas will debunk popular myths and include . . .

- How to find the perfect home

- Critical details for online property searching

- Secrets of beating other buyers to win your home of choice

- Information that reveals much more than days on the market

- The bold truth on automated values (e.g., Zestimate)

- Smart negotiating

Learn what to expect at every stage, with details you will hear nowhere else. Information is power; get it months ahead of others.

* * * * * * * * * * * * * * * * * * *

Here is GMU's entire Money Smart Day program.

Click here for a link to all David's GMU talks.

Click to read David's Buying a Home book free online NOW.

* * * * * * * * * * * * * * * * * * *

The course outline below has active links to additional information.

Buying a Home as a First-Time Buyer

- Read the Buying a Home book now free online

- Our focus is on first-time buyers in Northern Virginia

- Most laws are state-based

- Most customs are area (market) based

- Today’s Northern Virginia Market

- Subscribe to the free monthly report

- How to win your home of choice

- Please hold your questions for the end

- Email David at david@DrRealEstate.net

INFORMATION is POWER

- Benefits of home ownership

» Shelter

» Security / control

» Possible appreciation

» Monthly income tax benefits

» Exclusion of tax on gain upon sale? - Types of buyers

» Transferee

» Move-up

» Move-down

» First time

ASSUMPTIONS

| Price of home | $400,000 | |

| Down payment (20%) | $80,000 | |

| Mortgage amount | $320,000 | |

| Monthly payment | $1,968 | |

| » Principal | $461 | |

| » Interest | $1,067 | |

| » Tax (real estate) | $400 | |

| » Insurance | $40 | |

| Income tax deductions | $1,467 |

A 30-year loan at 4% interest is assumed.

There can be monthly homeowners or condo fees.

One-time “closing costs” are estimated at $12,000.

RESULTING BENEFITS

| Income tax deductions | $1,467 | |

| Your income tax bracket | 27.5% | |

| » Federal (marginal) | 22% | |

| » Virginia (marginal) | 5.5% | |

| Monthly payment | $1,968 | |

| Less monthly benefits | $864 | |

| » Tax savings (note 2*) | $403 | |

| » Mortgage reduction $461 | $461 | |

| Net monthly cost to buy | $1,104 |

Notes:

1-The $461 is out-of-pocket.

2*-The above will apply to those who itemize their deductions

but not to those who take the standard deduction.

3-All figures are estimates.

PLANNING

- The wisdom of the market

- The “news” –How old? National?

- Finding a home

» Signs and open houses

» Newspaper ads & homes magazines

» Online searching

» MLS computer search - Using a real estate agent

» Agent requirements

» Agency choices

» Is your agent your agent?

» Agents –Grains of sand? Snowflakes?

» The cost of an agent

FINANCING

- How much can I afford

- Down payment + loan

- Down payment 0% 3% 5% 10% 20% 25%

- Pre-qualification

- Pre-approval

Figures do not include mortgage insurance which is usually

required for loans with less than 20% down.

FINANCING

- Determine your maximum loan

- Fixed or adjustable-rate loan

- How long will you be here?

- Pre-payment penalties –to be avoided

- Negative amortization –to be avoided

- Balloon payments –to be avoided

- How interest rates affect your home purchasing power

FINANCING — Calculation I

MONTHLY| Gross income | $6,000 | |

| Maximum payment | $2,400 | |

| » Real estate tax | $488 | |

| » Fire insurance | $49 | |

| Principal & interest | $1,863 | |

| Max 30-year loan at 4% | $488,000 |

Monthly homeowners or condo fees can affect the calculations above.

Figures do not include mortgage insurance which is usually required

for loans with less than 20% down.

FINANCING — Calculation II

MONTHLY| Gross income | $6,000 | |

| Maximum payment | $2,400 | |

| » Real estate tax | $447 | |

| » Fire insurance | $45 | |

| » All other debts (car?) | $200 | |

| Principal & interest | $1,707 | |

| Max 30-year loan at 4% | $447,000 |

Monthly homeowners or condo fees can affect the calculations above.

Figures do not include mortgage insurance which is usually required

for loans with less than 20% down.

YOUR SPECIFICATIONS

- Step #1 –Setup financing

- Your limit and your price range

- Negotiability in the market

- Price versus location

- New or resale

- Detached / townhome / condo

- Style / age / lot size

- Bedrooms / bathrooms

- Online searching criteria to avoid

ON THE ROAD

- How to see 30 homes a day

- Taking notes –of what?

- Remembering your #1 choice

- Talking with sellers

- Waiting for that perfect home

- Adjusting your constraints

- The secret of finding the perfect home!

MAKING THE CHOICE

- Changeable versus unchangeable

- Days on the market . . . at this price

- Schools — Itz now or later?

- Adjacent vacant land

- An investment

- Does a “flow” for entertaining matter?

- Will you ever be selling?

- Your wants versus market wants

- State of the market

- Your choice — or 2 alternatives?

- Forms are standardized

THE NEGOTIATION PROCESS

- Who's in control here?

- From first offer to meeting of the minds

- Information is power

- Emotion (don’t nuke the process)

- To compromise or say “NO"

- New homes procedures

» Offers

» Who holds the earnest money

» Mechanics lien coverage - Reasonable & customary & red flags

THE NEGOTIATION PROCESS

- Verbal offers

- Seller considerations . . .

» Earnest money

» Source of down payment

» Mortgage qualification

» Price / terms / rationale

» Contingent on home sale

» Accept / reject /counter offer - Saving something for round 2

- Hot and cold markets – today's sellers’ plan

- Multiple offers and how to win

- The escalation addendum

NEGOTIATING TACTICS

- Planning the negotiation

» With your buyer-broker

» With an agent of the seller - Planning the offer

» Time on the market

» Time at this price

» Selling to asking price

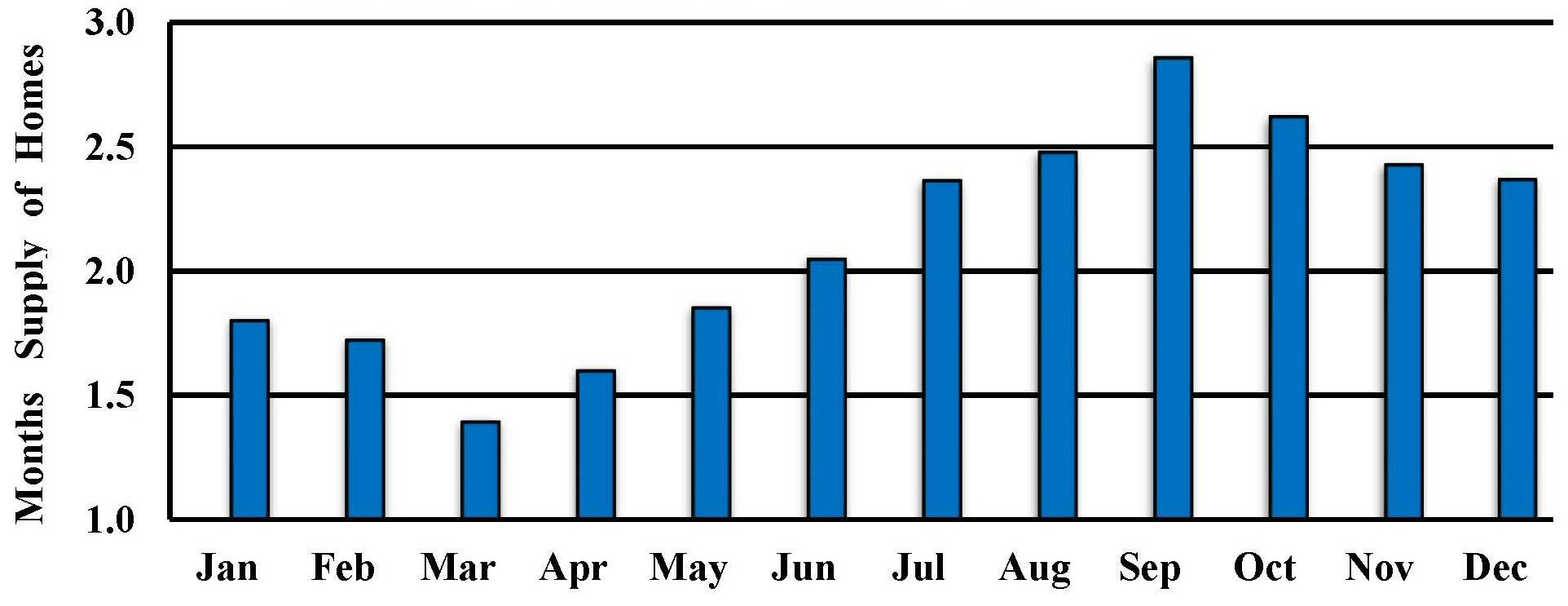

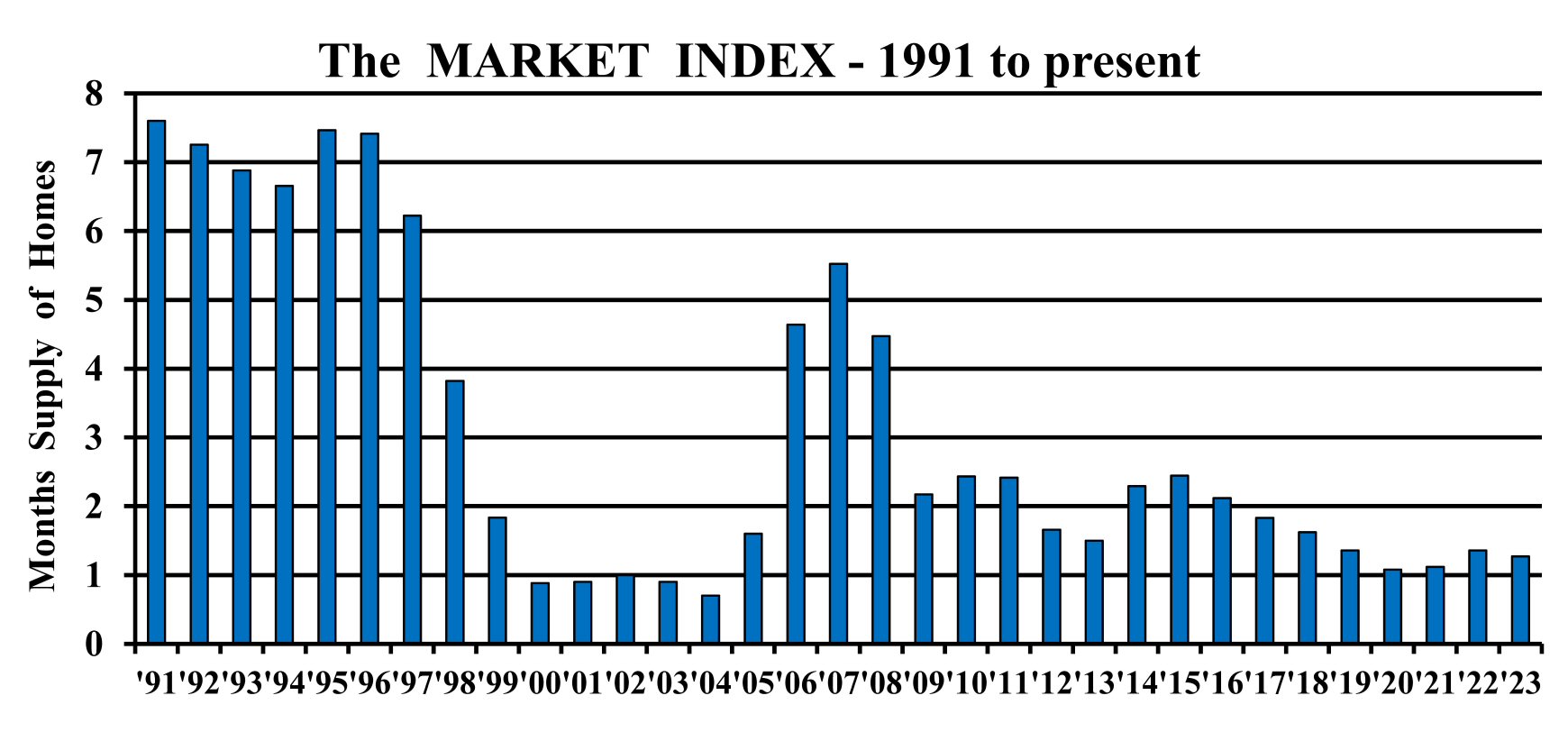

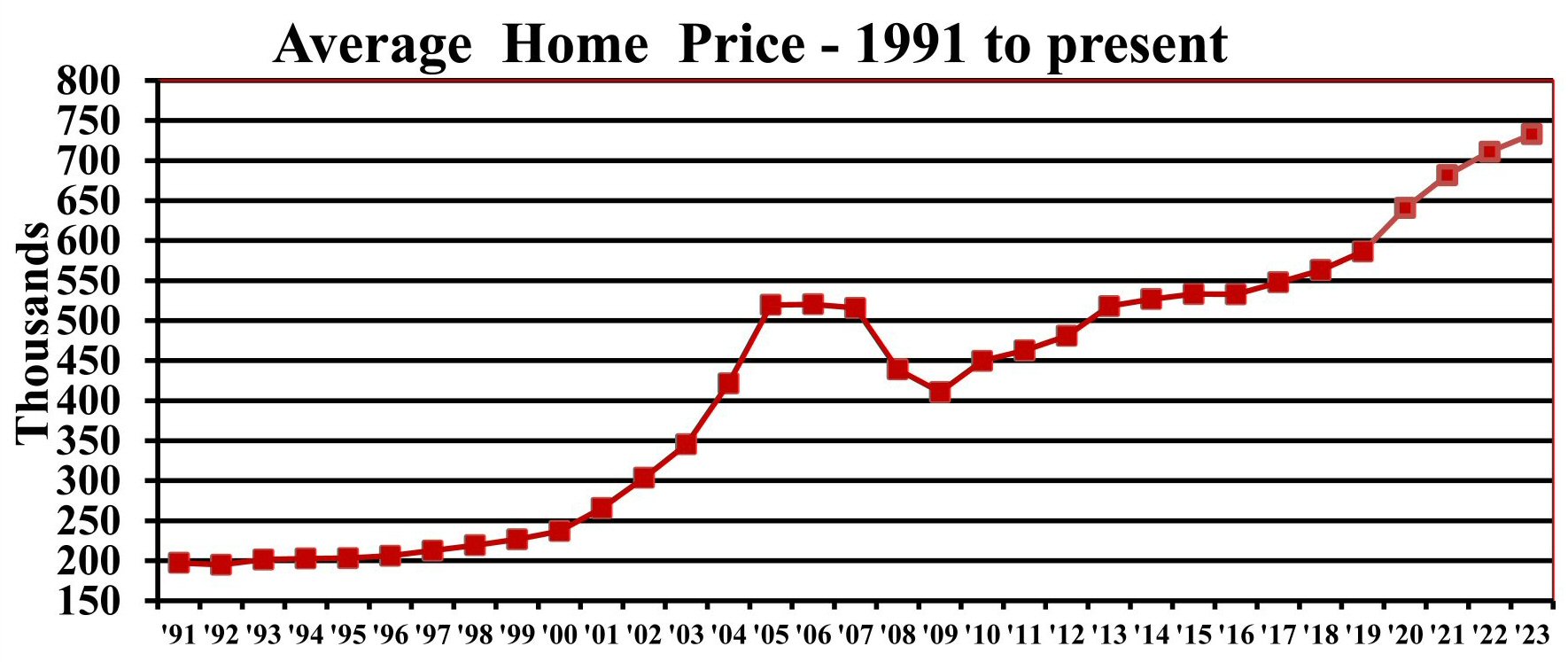

» Supply and Demand -chart

» Market index

» Time of year –chart

» Tax assessments

» Zillow etcetera!

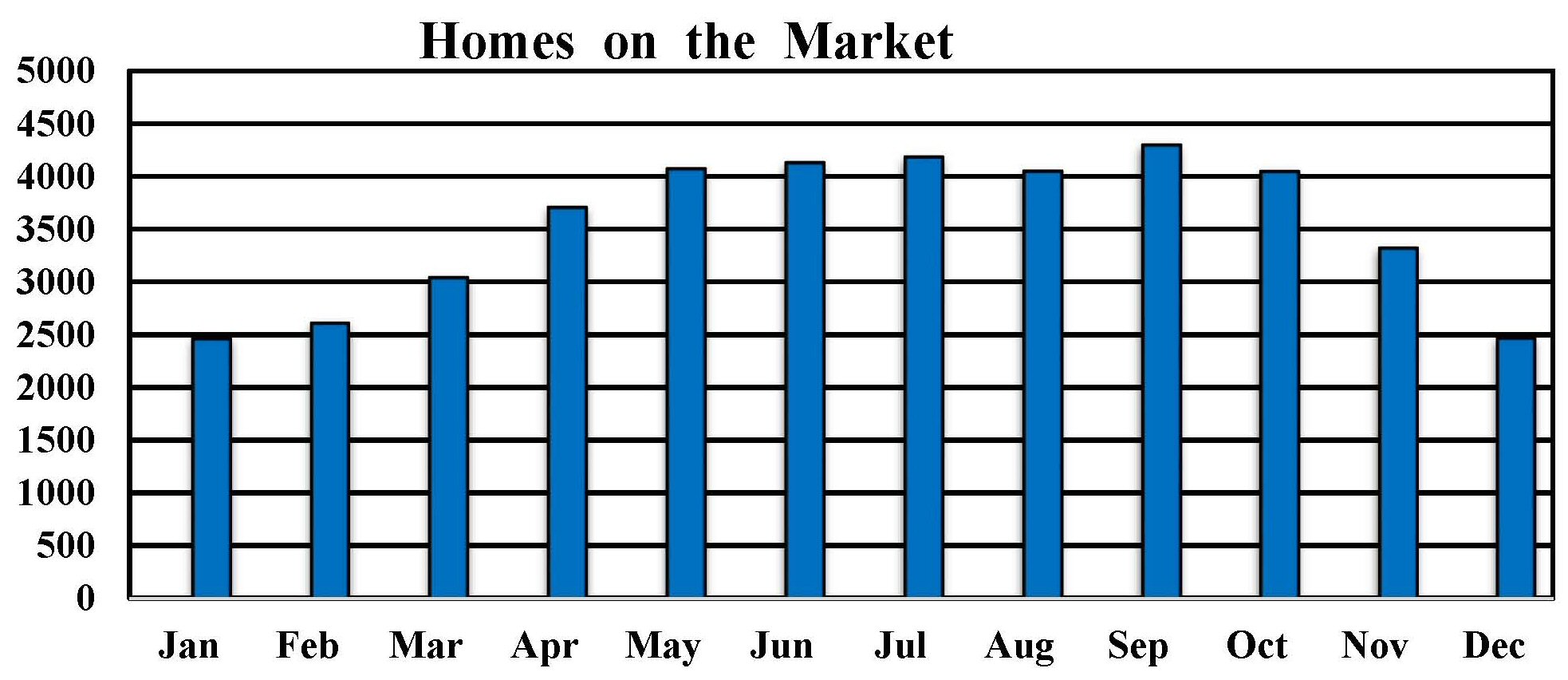

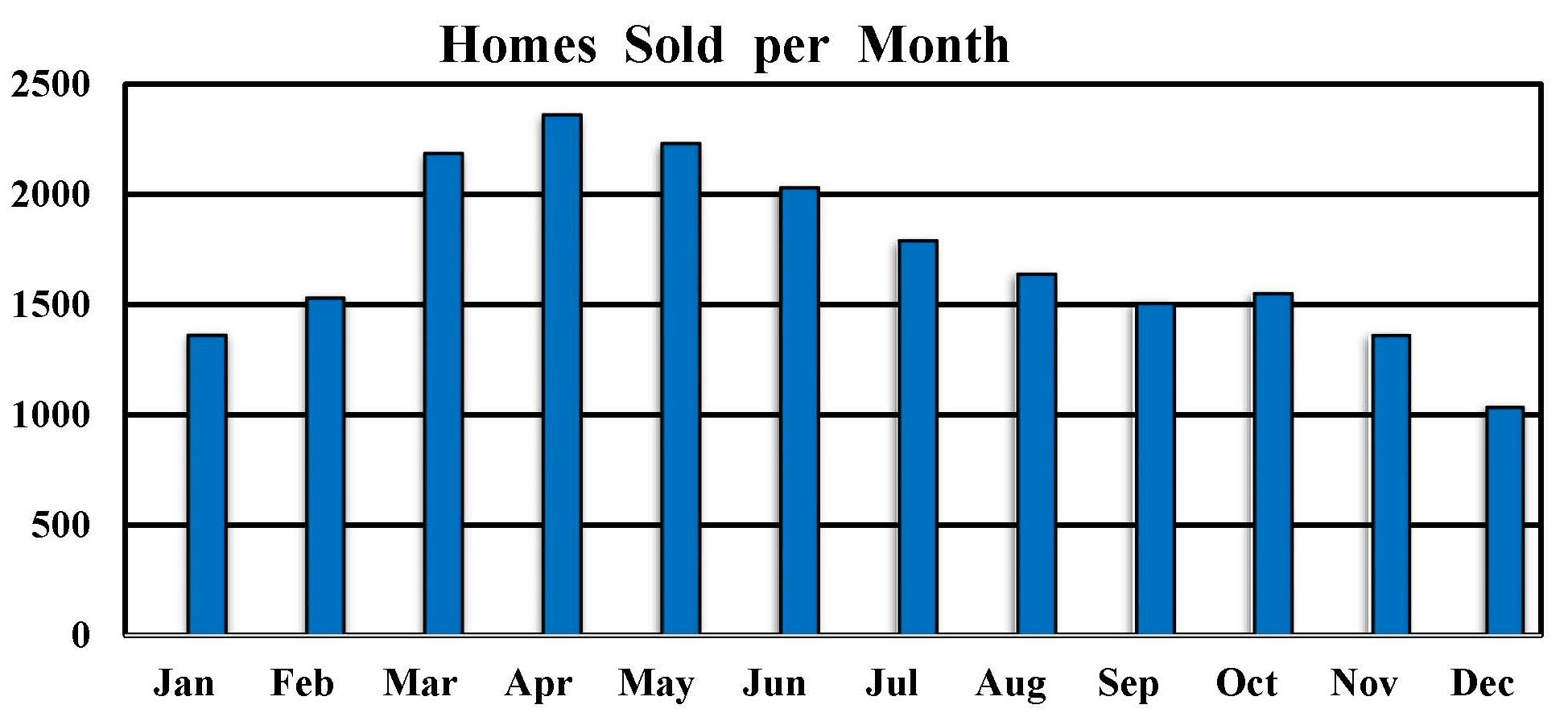

SUPPLY AND DEMAND

A MARKET INDICATOR

The NEW normal year!

The market changed in 2008.

What does SOLD mean?

The data for these charts is based on contracts entered in order to be timely.

Closings are old news and tracking them will put you a at least a month or two out of synch, maybe 3 or 4!

EVEN MORE NEGOTIATING TACTICS

- Using your situation

» First-time buyer

» Transferee

» Local buyer - If your offer is perceived as an insult

- Who's right & why?

- What's an average result?

- Time limits: written? are they real?

- Splitting the difference

- Take it or leave it: The end?

- Breakdown of negotiations

- The tip of the iceberg

ON TO CLOSING

- Timing –contract to closing

- Could you have paid less?

- Inspections & reports –trouble ahead?

- The appraisal

- The title search

- The survey

- The final inspection –all clear?

- The closing agent's role –1 hour

- Title insurance

» Lenders or owners

» Inflation rider

» Mechanics lien coverage - Have faith, smile, and keep signing

THE MARKET INDEX

NORTHERN VIRGINIA

TMI ???

- Smart Negotiating

- Decades of Timely Topics

- David's quotes in the national news

- Newspaper cover stories and series written by David

- David's articles for Realtor Magazine and other publications

- The $elling Your Home book

- The Agents Guide book

- The Statistics PERSPECTIVE for the Experts book

BUYING A HOME — The End

- Read the Buying a Home book now free online

- What sounds right can be wrong!

- Most news is recreational, NOT actionable

- Sign up for the free monthly market report by email

- Facing competition? Don’t miss this!

- Making an offer? Don’t miss this!

- Searching online? Don’t miss this!

- First-time buyer? Don’t miss this!

- To buy or to rent? Don’t miss this!

- About David

- Questions? — Email David at david@DrRealEstate.net

* * * * * * *

AFiRE — Licensed broker in Florida and Virginia

A Friend in Real Estate, LLC

* Copyright © David Rathgeber *

* * All rights reserved. * *