David Rathgeber's

$elling Your Home

in Northern Virginia

First Internet Edition

International Standard Book Numbers

0-9710312-5-8 and 978-0-9710312-5-8

Published by The Realty Research Group, LLC

This is the textbook for the George Mason

University – OLLI home-selling course.

Copyright © David Rathgeber - 2024

All Rights Reserved

You are hereby authorized to read this copy on your screen and to print one copy for personal use. You are NOT authorized to make any additional copy of any nature: paper, electronic storage media, or otherwise without the express written permission of the author. Violators will be vigorously prosecuted.

PLANNING

Initial Considerations

Some Basic Ideas

Basic Questions for Your Prospective Agent

Tough Questions for Your Prospective Agent

Final Questions for Your Prospective Agent

12 Interviewing Mistakes to Avoid

Exploding the Local Specialist Myth

How’s the Market?

Market Seasonality

Market Value Analysis

Marketing Strategy

Secondary Strategies and "Fat" for Negotiation

Round Number Pricing

Put Your Best Foot Forward

Home Preparation Checklist

MARKETING

Planning Your Marketing Effort

Critical Information

Bring on the BUYERS!

Do this . . . Don’t do that

What works . . . and what doesn’t

Showing Traffic

Does your home need a price reduction?

Discrimination in housing: Perspicacity

Average Days on the Market for SOLD Homes

FINISHING

Negotiating Basics

Presentation of the Offer

To Accept, Reject, or Counteroffer ???

Negotiating the offer: Information is POWER

Dealing with Common Negotiating Situations

After the Meeting of the Minds

Onward to Closing

Selling Your Home - an Overview

APPENDICES

(This is where the really interesting stuff is hiding.)

9 Steps to Success in Selling your Home

9 Critical Factors in Agent Selection

The only question needed to select the best agent

Real Estate Tax Assessments

Important Statistics

Put the NEWS into Perspective

Home marketing guidelines for Medicaid

Flashback Market Bulletin - November 2002

GLOSSARY

[Go to Glossary]About the Author

****************************

David Rathgeber ranks consistently among the top award-winning agents and is actively engaged in sales and marketing of residential real estate in Virginia. His comments and articles have appeared frequently in major newspapers, and he has written for the national REALTOR Magazine. His books incorporate the wisdom of over 3 decades of real estate experience along with his diverse technical and international business background. He holds a degree in Mechanical Engineering and a Master of Business Administration.

Note: Contact the author with your questions and comments, or for help buying or selling a home. See his web site for contact information, the local Market Report, other online books, and much more.

Foreword: The history of this book

************************************

In 1977 I attended the famous negotiating course given by Dr. Karrass and received a copy of his book Give and Take: The Complete Guide to Negotiating Strategies and Tactics. It was good reading, but I especially appreciated the small bite-size chapters, each only a few pages long. Fast-forward to 1993 when my first home-selling book came to the attention of Peter Vandevanter, the inventor and editor of the Washington Times Friday Home Guide. At his request, I sliced the book into bite-size excerpts that appeared almost weekly in the Washington Times for years. These excerpts have now been updated and assembled into this e-book.

PLANNING

Initial Considerations

This information will save you time, money, headaches, and possibly heartaches. Selling your home is an extremely important undertaking, and in these times, a complex one. You need to know what to expect before you begin. Accomplishing the task in the best fashion can make an enormous difference by enabling you to:

- Avoid a loss of over 10% of your home’s value.

- Spend much less time on the market.

- Plan your move when it is most convenient.

- Avoid major pitfalls such as getting tied up inextricably with an unreasonable, unqualified, or unwilling buyer; or selling your home to two different parties - it does happen.

You need the inside information to help you cut through the task with insight and direction. Although analytical, it is not just theory, but it contains verifiable facts and practical ideas that work in today’s market. The statistical data presented have been sampled and verified through the Multiple Listing Service (MLS) database that serves the region.

This information is intended to complement the experience and technical knowledge of licensed professionals. It will reinforce important concepts and will debunk more than a few of the currently popular myths, formerly known as "old wives’ tales" (is that the correct homonym?), which are running around loose in the local real estate market.

Other useful information of a more general nature is available from the following sources:

- Newspapers, libraries, and bookstores

- Internet resources (realtor.com / amazon.com / DrRealEstate.net / irs.ustreas.gov / and many, many more)

- Government agencies such as the Government Printing Office and the Internal Revenue Service

- Active and well-informed real estate agents

- Free publications from local real estate firms

- Local Associations of Realtors

- Real estate attorneys.

But stop for a minute and ask yourself if selling your home is the right thing to do. Most of us who have bought and sold a few personal residences over the years can imagine how much better off we would be financially if we had kept each home instead of selling it when we moved. So, maybe this is the time to start a real estate collection, save the trouble and expense of selling, and become an investor.

Some who have sold homes in the past have had to take money to the closing. Even some who bought homes many years ago might have this problem if they refinanced their property for a large amount of money and spent the proceeds. If you share this position and have a choice, you might elect to stay put until the equity in your home is a number greater than zero. Another option to avoid selling and moving is to expand your current homestead to accommodate present needs or desires. If expanding is for you, heed the following:

- Always seek professional advice, right from the concept and design stage.

- Be sure that the construction is of the highest standard and that the materials used complement the existing home, inside as well as outside.

- Obtain a professional opinion regarding whether your home’s new higher value will be recoverable when it is sold.

- Beware of over-improvement of your home compared with other properties in the immediate area.

- Recognize that the cost of adding space can be $100 to $200 per square foot and that the real estate market and appraisers generally value a marginal square foot at $30 to $50. This means that your next buyer might give you only $14,000 for an addition that cost $80,000.

Of course, there are legitimate reasons why you might elect to forge ahead on the selling trail:

- Need for a larger home, a larger mortgage, or a larger income tax deduction

- Unwillingness to become a landlord and property manager

- Need for your present home’s equity to purchase your next home

- Desire to raise capital for a business venture or an investment

- A job transfer out of the area

- Sudden loss of income.

Perhaps you have a reason of your own, but now is the time to sort it out. To sell or not to sell, is that the question?

For tax information, in addition to local accountants, some free Internal Revenue Service (IRS) literature might help:

- Publication 523 - Selling Your Home

- Publication 527 - Residential Rental Property

- Publication 530 - Tax Information for First-Time Homeowners.

These publications and many more, as well as tax forms, are available on the Internet at irs.ustreas.gov.

Now that you are firmly committed to selling your home, it will be of great value to determine where you will live after the sale. If your move is voluntary and local, consider whether you should find your next home and execute a contract contingent upon the sale of your present home, or sell your home first then find and purchase your next home. Selling first is clearly the only choice for most sellers in today’s market. If you wish to move directly from your present home to your next home, then the purchase of your next home probably will have to be executed quickly. If you are willing to rent temporarily between the sale of your current home and the subsequent purchase of your next home, you will gain flexibility, peace of mind, and a negotiating advantage at the expense of an additional move.

No doubt you have an idea of how soon your home needs to be sold. This factor will control many details of the process. So just in case this needs to be a quick sale hastened by bad news from your employer or mortgage company; let’s get moving (no fun intended).

Some Basic Ideas

The local real estate market is very organized and orderly. It is defined by those area homes listed for sale in the MLS computer database. Our area has a high proportion of sophisticated and intelligent buyers and a well-developed set of customs and procedures. The vast majority of home sales are made through real estate brokers who utilize a computerized MLS search facility in conjunction with a lockbox system. These features facilitate locating and showing properties.

Most buyers see many homes and weigh their decision carefully before making a purchase. After all, home buyers know that this is their last home purchase and that they will live here forever. Also, most are spending what they consider to be a large sum of money. They believe that a home not only should provide shelter but also should be a good investment, a comfortable abode, and a palace made for entertaining.

The impact of the above on a home seller is that, with all these considerations, a home purchase will not be made impulsively or emotionally. Home sellers who spend time and money searching for that one buyer who will pay 10% more than fair market value invariably find it to be a frustrating and unproductive exercise in futility. There might be a sucker born every minute, but they are not here in the D.C. metropolitan area buying homes.

For the reasons cited, the selling prices of most homes do represent their fair market values. The significance is that, because of the continuity and orderliness of the market, future prices can be predicted from recent sales. Exceptions to this rule are rare and usually result from one of the following:

- A home was not exposed to the market properly or for a long enough time.

- A transaction was not at "arm's length," for example, a sale between family members or a transaction with hidden considerations.

- A sale was forced by unusual outside pressure on the seller, for example, loss of income or serious health problems.

It bears repeating that the above exceptions are rare and that prices of sold homes typically represent fair market values.

You should not be surprised then that "the market," in its infinite wisdom, has already determined the selling price for your home, give or take a few thousand dollars. The idea of a well-informed, rational, and orderly real estate market is a most important concept that should be kept in mind as you proceed.

The most important decision in the home selling process is who, if anyone, will assist you. The majority of home sellers use a conventional, or full-service real estate broker. This option will be explored in depth later.

You have two other choices. First, a few real estate firms specialize in offering less than full service, usually at lower cost. If this idea appeals to you, further investigation is in order. But talk first with a full-service broker to define exactly what is offered. Then, knowing the answer, you are in a position to make an informed decision regarding which elements of full service you can do without, and what savings might be available. Be sure to ask when the commission is paid: Some firms ask to be paid up-front whether they find a buyer or not.

Second, there are the do-it-yourselfers, known as FSBOs (pronounced fizz-bows). The acronym FSBO stands for For Sale By Owner. One local study found that roughly one-third of FSBOs were successful in finding their buyer. Another one-third retained an agent eventually. The remainder never sold. Occasionally, one can see "For Sale By Owner" signs, but selling your home yourself is not recommended. A few of the reasons are the following:

- Limited exposure to potential buyers (less than 10% of what a broker will generate) which theoretically means ten times longer on the market.

- Such limited exposure will very likely lead to a lower selling price.

- Most buyers find it extremely awkward to negotiate or even to talk directly with sellers and therefore avoid FSBO properties.

- Lack of negotiating experience and lack of information often will result in a lower selling price, or worse yet, a bungled contract and possible lawsuits.

- Many buyers will pass by a FSBO home merely because they recognize that it is not in the real estate mainstream. This makes them wary.

- As most local buyers now retain an agent to represent them as their buyer-broker, you will probably be negotiating against an experienced professional. Further, the agent likely will be earning a commission on the sale of your home whether you pay it directly or not.

- Expected savings in broker’s fees will also be greatly reduced if you offer a selling commission to entice real estate agents to bring potential buyers.

Only real estate agents have access to the up-to-date market information. News reports cannot approach the timeliness or specificity available to agents. Further, real estate agents are involved in home sales much more frequently than the average homeowner is. This familiarity leads to a degree of expertise that provides an edge on negotiating and successful home selling.

Compared with even the best-informed homeowner, most agents have a much better idea of what to say, when to say it, and to whom. Expert agents also know what not to say, which can be of vital importance. If your do-it-yourself room painting job does not turn out quite right, it is easy to fix. If the bathroom tile job becomes overwhelming, an expert craftsman can be summoned. With home selling you are dealing with large sums of money, a complex process, and legally binding contracts that are frequently impossible to re-work. A do-it-yourself home selling job that seemed as simple as merely finding a buyer can become a nightmare because of unforeseen complications.

So why do any sellers take the do-it-yourself route? The reason is, very simply, that it is so easy to calculate the savings of being a FSBO: For example, 6% of $600,000 is $36,000 (and that’s a lot of money). But such savings will be cut to $18,000 if a 3% commission is offered to agents who bring a buyer. On the other hand, the financial advantages of hiring a capable agent are much harder to quantify and therefore seem less certain; but they do exist. The pitfalls likely to beset a FSBO seller are generally unknown to him. If they do come to mind, they are easily ignored until it is too late. (It is a blessing to recognize what you do know, versus what you don’t.)

Does this mean that you will need to deal with a real estate agent? You will be pleasantly surprised to find that the average real estate agent does not bite. Most can smile and behave pleasantly, if put to the test. A few have earned the coveted "human being" designation. Some might even qualify to become a friend. So, forge on fearlessly to learn how to select the best agent for your needs. But remember that the choice of an agent is much more important than the choice of a firm. The agent will play the central role in the marketing effort; the firm will play the supporting role if any. Home selling is an important undertaking, so stay tuned. (Ed note: If you know the derivation of "stay tuned," never admit to it!)

Basic Questions for Your Prospective Agent

Are you ready to interview prospective agents? Of course, the agents will try to impress you with their suitability. Many will welcome the opportunity to address your perceptive questions. You will be moving constantly toward your important choice.

If you meet agents in your home, many will expect a tour. Some will seize the opportunity to bubble over with exuberance about your home. Try hard not to be captivated by flattery. This is not the purpose of the meeting. In fact, you can save time and skip the home tour when interviewing agents. A tour removes the focus of the interview from where it should be: On the agent. Your home is not at issue. Any home can be sold. Save the tour for later, after you have selected an agent. Then you will get the best advice, undiluted by extraneous baloney.

The following set of questions deals with the candidate’s personal record and experience. Make it clear that you are not asking about the history of the agent’s office or of the real estate firm in general. These are not the most critical questions you will have, and most agents will expect them. Show that you are an informed seller.

How many homes do you have listed currently? Less than two or three can indicate inexperience or lack of a full-time commitment. If the answer is greater than 10 or 12, obtain assurance that there is enough time for you. Some agents employ a full-time staff. If administered properly, this can work satisfactorily, but find out who you will be dealing with on a day-to-day basis and for critical negotiations.

How many of your listings sold in the past year? In general, more is better, but an answer greater than five is probably sufficient to indicate a minimum level of experience. It reinforces a full-time commitment claim and should reasonably support the answer to the previous question. Most agents also work with buyers, which provides important complementary experience.

What was the average time on the market? First ask the agent about the industry average time on the market locally. Then ask the agent about the average time on the market for his or her own listings. Be wary of an answer that is too different from the average. But remember that while time on the market can give a very general indication of the agent’s effectiveness, time on the market is controlled much more directly by the seller: That’s you!

By now you should be on a roll. The next set of questions is very important in determining whether the candidate has the market knowledge required for the job at hand. It is customary to ask each agent to provide a market analysis that predicts the contract price for your home. Break with tradition. At this stage, focus on how the analysis will be done. Select an agent who uses the best method and you will avoid having to listen to several ill-conceived and misleading presentations. Also, you will avoid the temptation to simply hire the agent who predicts the highest price. This is one of the most common mistakes made by home sellers. It will always cause problems and cost you money.

If you absolutely must hear several agents’ ideas of market value, be clever enough to give no hint of what you believe your home is worth. This will obviate the possibility of any candidate telling you exactly what he or she knows you want to hear. But now, pose more questions about the proper method for determining your home’s value.

How will you determine the expected contract price for my home? Professional appraisers customarily select three (or more) similar or comparable, nearby, recently sold properties and make dollar adjustments to the contract price of each one in order to arrive at three (or more) estimates of your property’s value. These figures are then combined, though not necessarily averaged, into a single estimated market value. Your agent should use some form of this generally accepted method in calculating the estimated value of your home.

What is your accuracy record in determining expected contract prices? Some agents will not know. Some might guess. The one who checks his or her own record is the one who cares. See if the agent has a record of his or her performance and pay little attention to the actual number quoted.

Where should the initial asking price be set for my home? This question measures basic understanding of the current market. The correct answer depends upon the local average selling-price to asking-price ratio and upon the general rate of increase or decrease in area home prices. Be sure that your agent has up-to-date and specific information on these statistics. When these factors are known, you will be able to determine what to add to your expected contract price in order to arrive at your asking price. The amount added is sometimes called "fat for negotiation," and is often around 3 or 4%.

How is my tax assessment related to my expected contract price? Many people today are convinced that market values can be predicted somehow from government tax assessments, not to be confused with professional appraisals. Indeed, the stated goal of most local tax assessors is to assess properties at some percentage of market value. Of course, an average relationship between tax assessments and contract prices of recently sold homes can be calculated easily. But the idea that a government employee sitting in an office with some records and a computer can predict the market value of a specific home is ludicrous. If this were true, the entire professional appraisal industry would be out of business. If you must, call your local tax assessment office and ask what contract price you should expect. An agent who puts stock in tax assessments will be dangerous to your marketing program: You will very likely be setting too high an initial price or will be accepting too low an offer. Either will be disastrous. The wrong answer to this question is enough to disqualify a candidate. Zestimates are no better!

Tough Questions for Your Prospective Agent

Your prospective agent should be more than ready to tell you about the custom marketing plan that has been designed especially for you. If you review three marketing plans, you probably will find much similarity. So save a lot of time and politely forgo this step. In so doing, you will avoid the most common mistake made by home sellers: Selecting an agent because of the marketing plan. Agents do many things to help sell a home and to impress the seller that an exceptional marketing effort is being witnessed. Yes, more exposure is generally better, but one also needs to consider effectiveness. It is often difficult for home sellers to separate what really works from what really sounds as if it works.

Most sellers choose an agent primarily because of the marketing plan. Many agents perpetuate the notion that this is a good idea because they sincerely believe it to be true. However, as an important criterion for selecting an agent, the marketing plan does not even rank among the top three. As you will see from the next set of questions, your listing agent probably will never show your home to the eventual buyer and the most fabulous marketing plan will be for naught. Choosing someone primarily on the basis of "rah, rah, rah; sis, boom, bah" will not lead to a successful sale.

What usually sells your listings? The MLS? Signs? Advertisements? The industry average is overwhelmingly clear: Over nine out of ten home buyers come from the computerized MLS, not from the direct sales efforts of your agent. Signs and open houses account for the few remaining sales. Is the candidate in touch with the market? In our market, it is the MLS that sells. This fact explodes the myth that personal contacts and word-of-mouth selling have measurable effects.

In what percentage of your listings were you the selling agent? Be wary of an answer that is higher than one out of ten. It can suggest inaccuracy, or worse yet, a practice of "pocket listings," not entering homes promptly into the MLS.

How many times do you expect to show my home personally each week? Again, is the candidate in tune? Most agents will welcome the chance to confess at this early stage that, except for open houses and calls from signs, they personally will not show your home very often.

How many showings should we expect each week? If your price is in tune with the market, there should be at least 4 showings each week in order to sell within 8 weeks. For expensive homes, showings are less frequent and longer marketing times must be anticipated.

How many showings will we need to find our buyer? This question is another check on experience and provides valuable information so that you know what to expect. The number varies widely but a reasonable response is 10 to 30 showings. The experienced agent will know this number. It is an essential piece of information for an agent to possess whether working with sellers or buyers.

The most valuable exposure is through the computerized MLS database. It is about 50 times more important than whatever is in second place. Serious home buyers do not want to waste time. They know how to find a home: Search the MLS. It’s a lot quicker than attending open houses or chasing real estate signs. That is why over 90% of all homes are sold this way. No, your listing agent will not actually find your buyer directly. This means that the information entered into the MLS computer is critical to your success! Your listing agent is your connection to the buyer. Read on to learn where to look and what to look for in selecting an agent to put your home’s best footing forward. Your agent’s computer literacy is one of the most important factors.

Real estate agents include a diverse mix of personalities and capabilities. Some adjust to change; some fight it. Some are born computer nerds, and some will never know the difference between a bit and a byte, or between baud and bawdy. And some will never even care. A few well-placed questions will sort out your special computer nerd-agent.

What sells homes? If the answer is, "The MLS," then you are off to a good start. You have an agent who understands market basics. Conversely, an agent who thinks that his or her "dynamite marketing plan" is going to do the trick is way off base and might look at the MLS data-entry job as something to finish as soon as possible with as little thought as possible.

MLS computer entry is very important. There are many critical decisions involved in filling certain fields so that other agents searching the MLS will find your home for sale. Some of these items will be hard for you to check, so remember that your agent must think like a computer in order to enter your home in a manner that will maximize the number of times it issues forth in other agents’ searches. And when your page does pop out of the computer, the information there needs to say, "come visit me." Like life, there is no substitute for experience and good judgment. Choose your agent carefully!

Final Questions for Your Prospective Agent

The next set of questions is of greatest importance and, unfortunately, will take many by surprise. These questions deal with the agent’s personal negotiating record and will give an indication of negotiating skill. Do not omit these questions. A favorable response is mandatory. The answers have a direct bearing on your bottom line.

What is the selling-price to asking-price ratio for your listings? In other words, when an offer arrives, how close to full price are you able to negotiate for your sellers? The answer is too important to rely on an estimate or recollection. Be sure to see a written tabulation of MLS data from the agent’s recent sales. Since many agents will not have this information readily available, ask that it be sent along or dropped off at your home as soon as possible. A survey of six top selling agents from several different firms revealed personal averages between 85% and 96%. To determine the importance of this single question for yourself, just calculate 11% of your home’s value. This is the difference on your bottom line between selecting a 96% agent and an 85% agent. And you can surely do worse if you leave the matter in the hands of fate by failing to obtain a definitive answer to this question.

What is the industry’s average selling-price to asking-price ratio? Every knowledgeable agent needs to have some idea of this ratio whether working with buyers or sellers. Compare this answer with your candidate’s answer to the question above. Is your prospective agent’s personal record better than the average? The average also has great value when setting the asking price, after you have an idea of the fair market value of your home. The correct answer is often between 95% and 99%. Ask your agent to determine the latest figure.

By now your candidate is in awe. Are you an agent? How did you ever learn so much about real estate? DON’T TELL. The fun is just starting. You are about to find out, firsthand, how good a negotiator you have. Ask what commission the agent charges. Remember that commission rates are not set in any manner by any body, or by anybody. They are set by negotiation between you and the broker, which strictly speaking, is the real estate firm. You may assume that the agent has some latitude to speak for the firm regarding commission, so go ahead and ask. Plan to have two or three reasons why you should pay a lower commission than that requested. Be prepared to press your point a bit.

Eliminate any agent who is willing to give up a significant part of the commission. Why should you pass up such a saving? Some reasons follow:

- For an agent to request a commission and then be negotiated out of it indicates a lack of negotiating skill. You need an agent who is an even better negotiator than you are.

- When you are successful at cutting the price, you will wonder later whether the agent is cutting the service. Do not sow the seeds of mistrust!

- Most of all, if an agent is so careless with his or her own commission, you will not want to trust his or her counsel for your money at the contract negotiating table.

Score extra points for the agent who explains that the commission structure is set to be uniformly fair to each client: past, present, and future.

The following are optional questions of lesser importance.

Do you specialize in my type of property? If your candidate makes such a claim, find out how such specialization benefits you. Remember that your listing agent will rarely show your home in person and therefore will rarely get to impress a potential buyer with his or her expertise. Also, what kinds of business does the agent refuse in order to specialize? With modern technology and a little ambition, it is very easy to cover the entire residential spectrum. Ask yourself why an agent chooses to be self-limiting by specializing.

Will you market my home alone or with a team? Suit yourself; it can work either way. Are you being given a choice? Ask who will be your main contact.

If you use the following questions, have the agent’s business card handy for reference.

Are you licensed as an agent or as a broker? A broker’s license requires more education, testing, and experience.

Did you win any sales awards last year? Most firms as well as the Realtors’ associations give awards. An award can generally help substantiate an agent’s experience claim.

Have you earned any professional designations? These are usually based on classroom education. While professional designations are valuable, remember that they are not a substitute for experience.

The following are a few questions that are better left unasked.

Do you currently have a buyer for my home? This question invites trouble. First, the theoretical likelihood of this happening is probably about one sale in 25 million. In practice it probably occurs more often, maybe one sale in two thousand. (Not great odds.) Second, if you still think you are hiring an agent to find your buyer, throw this newsletter away! If the agent does have your buyer in waiting, be assured that he or she will be on your doorstep as soon as your home is listed, no matter who you list it with. If you are really enticed, tell the agent that he or she will not be your listing agent but that you will execute a 3-day listing with him or her for named buyers at a reduced commission. But keep your eyes open for trouble, delays, or both.

Answers to these questions will ensure that your agent has, without doubt, the experience, market knowledge, and personality to serve you well. In addition, you will be assured of your agent’s communicating and negotiating skills, which are absolutely crucial to your success, especially in this era of buyer-brokerage.

Do not forget that your feeling of trust, your agent’s computer literacy, and your agent’s negotiating expertise are the most important factors in selecting an agent. Your agent’s superior record is proof of market knowledge and experience. No doubt this has been an exhausting procedure but rewards will accrue in personal satisfaction, time, and money. Once you have chosen your agent, the rest is easy.

12 Interviewing Mistakes to Avoid

Home Sellers: Are you interviewing agents thinking you will learn all their secrets? Here's the real secret: Every transaction is different, and a lot can go wrong. You will not be sure that you hired the right agent until you are negotiating the unforeseen bumps in the road.

Avoid serious mistakes: Do not select an agent who:

- . . . swoons over your home: Remember, it's about the agent not about your home! Don't get confuseled.

- . . . does not understand round-number pricing: This can be very important! Review a few of an agent's recent listings to check their past pricing policy.

- . . . has the dynamite marketing plan or one who claims to have a unique, exclusive plan: Don't fall for the gimmicks, known in the trade as "listing tools." Nasty: These things sound good but are absolutely worthless in practice! Further, your agent's direct sales efforts are insignificant in comparison to the efforts of thousands of other agents using the MLS to find your buyer.

- . . . is not computer-literate: Your agent will not personally find your buyer. The information entered into the MLS is critical to your success! Your listing agent is your connection to the buyer. Your agent's computer literacy is one of the most important factors in putting your home's best foot forward.

- . . . claims to be a specialist: Your agent will rarely show your home in person, and therefore will rarely get to impress a potential buyer with local expertise. What does your local specialist know that you don't know?

- . . . suggests the highest price: Do you think an agent would suggest a high price just to win your listing? Hhhhmmmm! Remember, it's the contract price that's most important, not your initial asking price.

- . . . uses Zillow or tax assessments, etcetera to price your home: This "data" is pure baloney; that's why mortgage lenders are still requiring appraisals.

- . . . plans to use a combination lockbox on your home, which makes no record of who entered. Worse, some can be accessed by anyone even if they do not have the combination. (Instructions can be Googled.) Be sure you get the SentriLock (electronic) lockbox.

- . . . claims to have a ready buyer: This is downright dangerous, and is an excellent reason to select a different agent to represent your interests.

- . . . cannot meet with you for a week: Anyone who is that busy should not be taking on new business.

- . . . is from the closest office location: Sales from office call-ins and walk-ins are non-existent.

- . . . is with a certain real estate firm: You will never meet Mr. Long who is long gone nor Mr. Foster who has retired. Agents are as different as snowflakes, regardless of their company. Get the right agent.

Don't miss the items in the appendices which provide further guidance on agent selection. And again, beware: Any agent who has been in the business for more than a few months is familiar with the term "listing tools": Ideas that sound exciting or unique but have absolutely no basis for being effective. It is nearly impossible for home sellers to distinguish between ideas that really work, versus ones that merely sound good. Listing tools are routinely used in listing presentations, supported with flimsy anecdotal examples, so be prepared.

[Return to Top]Exploding the Local Specialist Myth

Your home's most valuable exposure is through the MLS. It is 50 times more important than whatever is in second place. Well over 90% of all homes are sold through the MLS. No, your listing agent will not actually find your buyer directly. Your listing agent is your connection to the buyer. Your buyer will come from the MLS through another agent, not from the direct sales efforts of your listing agent.

Your listing agent will rarely show your home in person and therefore will rarely get to impress a potential buyer with his or her local expertise, assuming it exists at all. The first time your listing agent meets your buyer likely will be at the settlement table! Your listing agent's job is marketing, not selling. There is absolutely no unique information that a local specialist possesses. What does your local specialist know that you don't know? Nothing! Further, don't waste precious words or dilute your remarks in the MLS trying to sell your subdivision or area.

It is often difficult for home sellers to separate what is really important from what only sounds really important. But all agents are not created equal. Selecting the right agent will reap rewards in personal satisfaction, time, and money.

How’s the Market?

It might be surprising to find that the current value of your home has already been determined by market forces. "The market" somehow knows how to value your home’s location, number of bedrooms, and even its uniqueness. Indeed, every home is unique and yours is no different. Just think about it for a moment! If you expect to find that one buyer who will appreciate everything you have done to your home and pay a handsome premium over market value for it, you are searching for a fool who is your clone.

Most buyers search for a home over a wide area and see many homes before they purchase. Therefore, there really is no unique market or even niche for your area, your subdivision, or your home. By realizing this, you acknowledge that you will have to compete with other sellers for a buyer. And in a competitive environment, it is imperative to know the market.

It is important to have an accurate idea of your home’s market value. You might use it to briefly reexamine your decision to sell. Should you rent the home? Stay in it? Sell it? If you decide to proceed with selling, an accurate estimate of its value gives you a preview of what is at the end of the home selling journey. With this information, you can plan your marketing strategy more effectively and possibly even enjoy the trip. Your carefully selected agent can usually predict your home’s market value within a few percent.

But how does "the market" determine your home’s value? How can we find out what the market already knows? What are the critical factors? And how can we exercise maximum control over the outcome? To be sure, the market neither knows nor cares:

- What you paid for your home

- How much money you have spent on improvements

- How much money you need from this home sale in order to buy your next home

- The amount of profit you feel you are due from your home sale.

Before we consider the market for your home, we must examine the overall supply of homes on the market, and the demand for them, in order to place your sale in perspective. There are seasonal variations: The number of homes on the market peaks around midyear. There is a common misconception about the market cycle. Ask anyone when it is best to put your home on the market. They will recite that many buyers have children and wish to move in the summer when school is out. Then they will tell you to put your home on the market in May or June. It makes perfect sense, but it will be a big mistake to follow that advice. Another example of "what everybody knows" being just plain wrong!

The mystery unfolds when demand is considered. It will surprise most folks to find that that the number of homes sold (contracts entered) usually peaks in March or April. "Spring" buying activity starts in January. In May or June, there will be fewer buyers chasing after more homes. This will mean a longer marketing time and possibly a lower price for you.

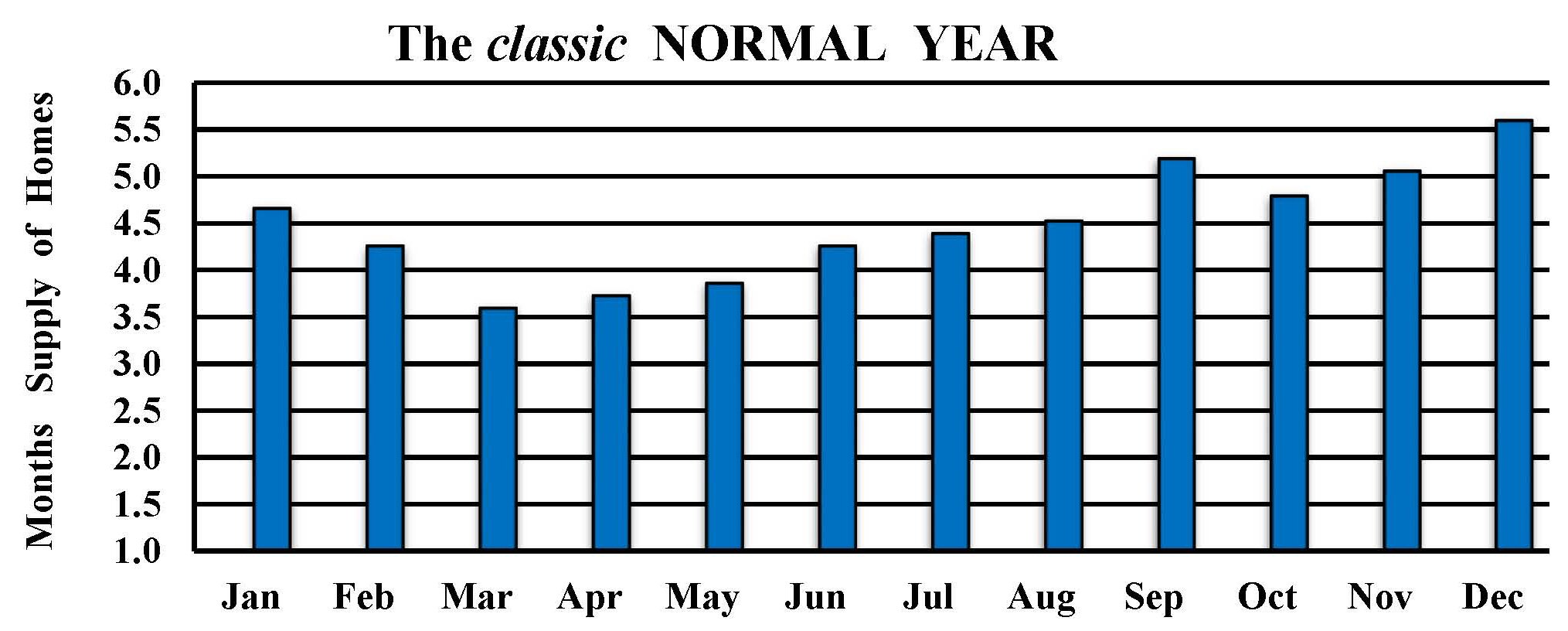

It is possible to develop a "Market Index" to show the combined effect of supply and demand. Months supply of homes on the market can be easily calculated: Divide the number of homes on the market in any month, by the number of homes sold in the same month. Conceptually, it indicates when the current inventory of resale homes would be exhausted if buyers kept buying at the current rate and no additional homes came onto the market. Of course, this never happens.

A months supply figure of less than 3.0 favors sellers while a number greater than 5.0 indicates that buyers have the advantage. This concept provides a general assessment of the strength of the market which is critical information for home sellers. To get this information months ahead of anyone else, visit www.drrealestate.net and click Market Report.

Market Seasonality

The graph above incorporates supply and demand into a single number and shows seasonality of the real estate market. This is the classic case of how the market should behave. It shows sellers’ best market to be in March, not June and July as you often hear. It shows buyers doing best in December. Note the September "slump."

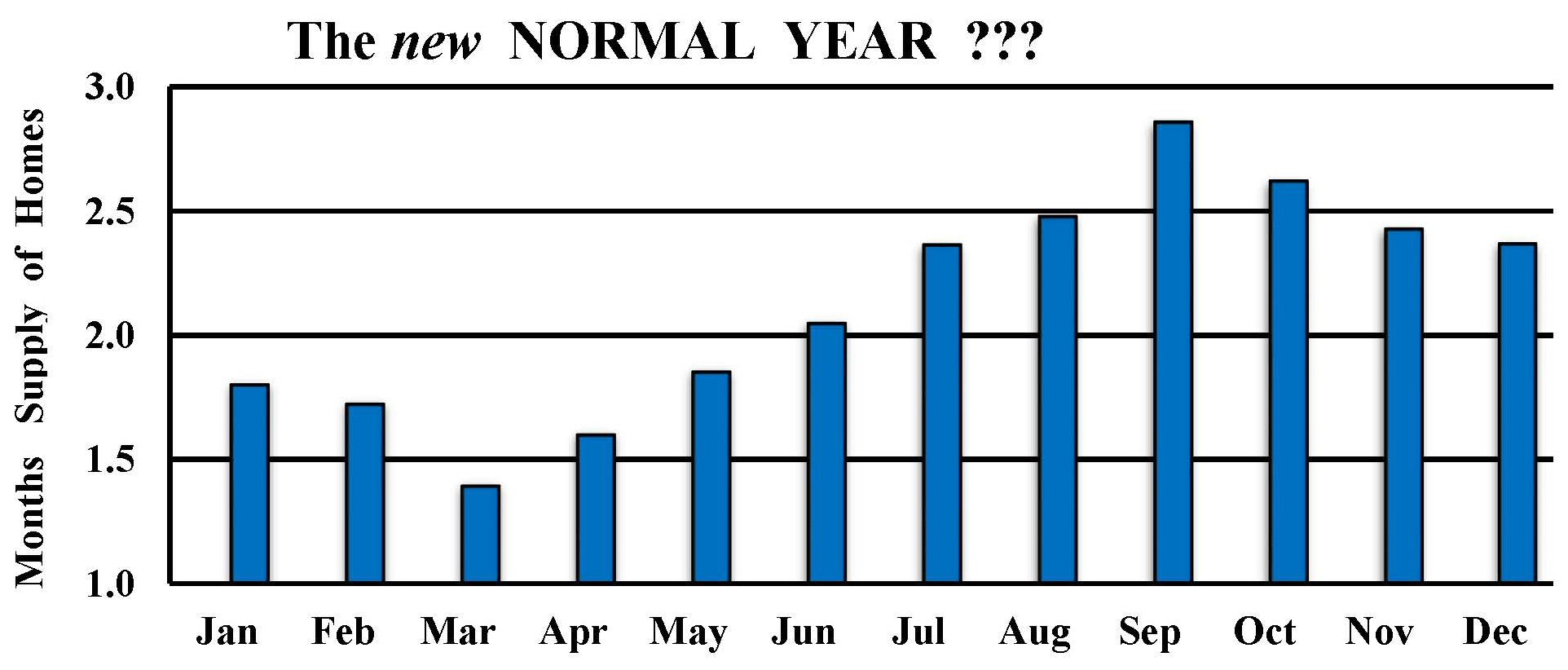

The graph below incorporates supply and demand into a single number for each month and shows the seasonality of our real estate market in recent years. Sellers still have their best market in March, not June and July as you often hear. But buyers now do best in September; not December anymore. This is the new normal.

What has changed? The seasonal pattern and shape of the demand (number of homes sold) chart has not changed with peak sales usually occurring in April. The seasonal pattern and shape of the supply (homes on the market) chart has flattened. There is now very little change in supply from May to October, and the average number of days on the market is much lower than years ago. Both supply and demand are decreasing in the final months of the year as always, but the supply decrease has become the controlling factor.

Caution: Most information in the media is 2 to 4 months out-of-date: Media reports are generally based on closings, not contracts entered, and there is an additional lag before publication. If you want to sell when buyers are writing contracts, rather than months later, act on up-to-date information. For example, their reporting of strong "sales" (closings) for June (usually reported in August) is probably due to contracts entered in April.

Market Value Analysis

If you are selling your home, you will need an accurate idea of your expected contract price or market value. Can your agent help with this? While some agents might present you with a wad of printouts and offer a ration of verbiage about your expected price, others could take a more direct approach and merely ask you what you would like. Still others will check with the local tax assessor’s office, deferring to them the decision on your home’s value. And finally, your own guess will usually be more accurate than any of them, or even Zillow.

None of these methods will be satisfactory to you or your agent, who will be happy to prepare an "appraisal style" market value analysis. It is the method that is important, not the look of the report. At this point we should reinforce the distinction among the following:

- Your tax assessment is set by a local government official and is the basis for your real estate tax bill and nothing more.

- An appraisal is an estimate of your property’s market value prepared by a professional, state-licensed appraiser. It is several pages long, is prepared in conformance with a set of accepted guidelines, and is required by mortgage lenders before making a loan. A fee is charged for this service.

- A market value analysis is prepared by a real estate agent. When done properly it follows the form of the appraisal method called "determination of value by comparables" or "the sales comparison approach" but does not necessarily conform to a detailed set of guidelines.

There is wide latitude for the use of judgment in an agent’s market value analysis: Good judgment will produce a superior result. A description of a typical market value analysis follows, so that you will have a better idea of the procedure. This will facilitate your review of the analysis that your agent prepares in order to predict your home’s market value or expected contract price.

The critical first step in the process is finding three (or more) similar sold properties. "Similar" does not mean exactly the same. A proper choice requires judgment and experience but the ideal homes are within a mile, have sold within the past year, and are the same style, colonial, for example. The choice is sometimes obvious, sometimes nearly impossible. Properties currently under contract, sold but not yet settled, can be used but your agent must obtain the contract price from the listing agent.

The procedure uses sold properties to predict market value. Asking prices of homes on the market cannot be used for this purpose: They will predict only a price at which your home will not sell because these properties have not sold yet themselves. But if the asking prices of some similar nearby homes are so low that you might not be able to achieve the predicted contract price, then the analysis should be repeated using those homes. Information from unsold properties should be used only to answer the question: How much do you need to lower your expected contract price (which was predicted from the sold properties) as a result of the low asking prices of the nearby homes? Do not fall into the trap of spending time and effort predicting a price that is too high, and which will only keep your home on the market unsold. It is easy to find a price that is too high without all that complicated analysis stuff. But resolve to do it right. By comparing your home with sold properties, you will be setting the stage for your home to be sold.

The contract prices of comparable properties that sold more than a few months ago could be adjusted for time, that is, for appreciation or depreciation. But this adjustment will not be required in a market where prices move very slowly. Next, significant differences between your property and each comparable property must be identified and dollar adjustments made. Dollars will be added to the contract price of a comparable home for features your home has but the comparable home does not have. Think of this procedure as "buying a deck for the comparable" to make it equal to the deck that your home already has. Dollars will be subtracted from a comparable home’s contract price for features it has but your property does not have. Think of this procedure as "taking the value away from the comparable home" for its two-car garage that your home lacks.

The list of features that make a difference is almost endless, but items with a value less than about $500 can usually be ignored. No adjustment, positive or negative, is required for any feature that both your home and the comparable property have. Values assigned to features are a matter of judgment. They should measure what today’s buyer will pay for that feature in a similar home. Values are not the original cost of the feature, nor its replacement cost today. The classic example is a $50,000 in-ground swimming pool, which often is found to be worth only $10,000 or $20,000 to a typical buyer. Condition is important, but difficult to gauge.

Also keep in mind the concept of marginal utility: A home's first bathroom is almost a necessity, and as such is probably priceless; the second bathroom can be valued at a bit less; but having seven bathrooms instead of six will be nearly worthless to the average home buyer. Similarly, if you added 10% on to the floor space of your home, its value would normally increase by something much less than 10%. Another example is that a single (indivisible) one-acre building lot does not sell for four times as much as a quarter acre lot, assuming they are in the same general area.

When the contract prices of the three comparable properties have been properly adjusted with appropriate positive and negative values, you will have three individual estimates of your home’s market value. These three numbers should be in a reasonably tight range. Using experience and judgment, your agent can suggest a single expected contract price for your home. This figure need not be the arithmetic average nor the median value.

A decades-old example of what an agent's appraisal-style analysis might look like is below. An appraiser's full report would be many pages, but the analysis below demonstrates the concept.

| Comparables | EnglishMillCt | FoxMillRd | OaktonWoodsWay | |

| Date sold | July 1991 | Sep 1991 | Dec 1991 | |

| Sold Price | 416,000 | 410,000 | 430,000 | |

| Time Adjusted Price | 416,000 | 410,000 | 430,000 | |

| Positive Adjustments | ||||

| Backs to parkland | 0 | 12,500 | 12,500 | |

| Location | 0 | 20,000 | 0 | |

| Walk-out basement | 3,600 | 0 | 0 | |

| Negative Adjustments | ||||

| Extra bathroom(s) | (3,600) | (2,200) | 0 | |

| Extra fireplace | 0 | (1,700) | (3,200) | |

| Home size | 0 | (16,520) | (34,930) | |

| Lot size | 0 | (20,000) | (10,000) | |

| Pool | 0 | (15,000) | 0 | |

| Total Adjustments | 0 | (22,920) | (35,630) | |

| Adjusted Home Value | 416,000 | 387,080 | 394,370 | |

| Subject Property | History Drive | |||

| Probable Sale Price | $395,000 |

Note that the probable sale price is neither the average of the 3 comparable homes, nor is it a suggested asking price.

It takes a lot of experience to prepare an accurate market analysis. The above will help you recognize a properly prepared analysis and appreciate the underlying concepts.

Marketing Strategy

Your marketing strategy is an overall plan, in other words, the big picture. What are you trying to accomplish? By what time? How can it be done? There is nothing wrong with high aspirations or the "power of positive thinking." But if your goals are not realistic and you think that you or your agent can control the market, eventually you will realize the folly.

There are three basic strategies to consider, one of which will suit you. They are:

- The classic approach

- The (maybe) top dollar approach

- The quick sale approach.

Through the entire home selling procedure remember this: You are the seller. You decide what your price will be at any given time, and whether you will accept any particular offer. Also, you will reap the benefits from your good decisions or bear the consequences of your less-than-good decisions.

The classic approach to a marketing strategy is the mainstream approach rather than one of the extremes that will be discussed later. It is the correct strategy for more than 90% of home sellers and is probably the right one for you. In the classic approach, you will enter the market at exactly the right price and sell in two to ten weeks. If you sell in less than a week, your asking price might have been a bit low. Do not worry too much about this happening to you. It’s rare. Further, it can be "self-correcting" if handled properly. But if your home languishes on the market, the price has proven to be higher than the market will bear. Up to 50% of home sellers err on this side and cost themselves time and money. Your agent can point out many local properties that have been on the market too long.

To accomplish the classic approach, you will start with the expected contract price from your home value analysis as described earlier. To that, you will add a small amount for negotiation, usually about 5% of your home’s market value. That is much less than many would guess. But why guess? The average home’s selling-price to asking-price ratio is often around 95%. In other words, all you have to give at the negotiating table is 5%, much less if you have done a good job of selecting an agent with a superior negotiating record. It might be a good idea to ask your agent to run an updated selling-price to asking-price ratio calculation as discussed earlier. A tailored calculation can reflect your price range or geographic area. However, the MLS data must be taken at random and must include at least 200 recent sales in order to ensure the statistical significance, or reliability of the information generated.

In all but the slowest markets an asking price 5% above the predicted contract price is a good starting point. In a slow market this will provide the required fat for negotiation. In hot markets the 5% uplift will help "lead the market" and provide some assurance that you are not pricing your home to low, as home prices rise.

Why does this work? The classic approach holds that at any time your home enters the market, there are a certain number of ready buyers, let’s assume 25, milling around in search of a home similar to yours. They have seen everything currently on the market. Within a few weeks these 25 buyers will notice your new entry on the market, visit it, and form an opinion of it. If everything is right, including the price, your home will sell to one of these buyers. If not, you will never see them again; perhaps because they purchased something else or felt they had no need to see your home again later, even at a lower price.

After this "initial wave" only buyers newly entering the market will visit you. This number is rather low and will produce, for example, only one or two visits weekly. But if someone in the initial wave did not buy your home, the newly entering buyers probably will not buy it either and your home’s asking price will need to be reduced.

The classic approach is usually the best approach, but even with the best plan, occasionally your home will not sell in ten weeks. Results do vary. The numbers above serve to illustrate the theory. In the real world, the decline in buyers’ visits is not precipitous: Do not look for exactly eight visits per week for two weeks, followed by an immediate drop to one or two visits per week. And remember that it takes at least two weeks to establish a trend. Good judgement comes with experience.

The classic approach will give you a reasonable chance of obtaining multiple concurrent offers. If you are fortunate enough to generate the concurrent interest of more than one buyer, you will be in the strongest position to get your full asking price or more, with other terms to your complete satisfaction. The next issue will detail two alternate marketing strategies.

Secondary Strategies and

"Fat" for Negotiation

The (maybe) top dollar approach to a marketing strategy is right for very few sellers and will be discussed mainly to define it so that it can be avoided. It attempts to maximize price at the expense of time.

To accomplish this approach, you again start with the expected contract price and then add 10% or 15% to determine the initial asking price. Set your last asking price at about 10% lower than the expected contract price. Next, divide the difference between the higher and lower prices into steps equal to about 5% of the expected contract price. Finally, schedule these price steps evenly throughout the marketing period available, or the maximum acceptable time for your home to be on the market. The following is an example for a home with an expected contract price of $500,000 and six months available for marketing it:

- March 1, $550,000 (initial asking price)

- April 1, reduce the price to $525,000

- May 1, reduce the price to $500,000

- June 1, reduce the price to $480,000

- July 1, reduce the price to $460,000.

Your prices and times will no doubt be different.

The top dollar approach seems logical enough and certainly will sell your home if the plan is followed. If you consider this approach, keep a few things in mind. The cost of keeping most homes can approach 1% of the market value per month, or $5,000 monthly in the example above. If your home will be vacant, you could lose $30,000 in six months. Remember, it will be a month or two from contract to closing.

In times of rising market prices, this approach has slightly greater appeal. If the price happens to be a bit high, market appreciation overtakes the error and the home sells in a few extra months. In a stable market it is questionable whether this approach will mean extra dollars. In a market of falling prices, it can be a disaster: If your reductions do not overtake the falling market, you will sell much later at a much lower price as you "follow the market down" never at quite a low enough price to sell until desperation shocks you into reality.

The quick sale approach also is not suitable for many sellers. It minimizes the time on the market at the probable cost of several thousand dollars. But if you need to sell quickly, you will be the first to see that this approach is for you. Your home will enter the market at an asking price about 2% to 5% lower than the expected contract price and it should sell quickly.

Be very firm when negotiating. If you counteroffer, supply the selling agent who brings the offer with data to support your price: Your market value analysis, an appraisal, or comparable sales. Address this information to the prospective buyer, via the agent. Above all, be calm, reasonable, and firm. Do not appear anxious. If your buyer gets the idea you are in trouble, you indeed will be in trouble. If the negotiations are conducted properly, the buyer will agree reluctantly from the data presented, as well as from his or her own knowledge of the alternative properties available, that your home at your price is the best option.

The quick sale approach maximizes your chance for multiple concurrent offers. If negotiations take a couple of days, your chances improve. If your listing agent can develop a second offer, you could end up with your full price or more without having to make any concessions, such as paying points for the buyer’s new loan or giving any other "seller credits."

If you are in a tight spot (for example, in default) with your mortgage holders, advise them of your plan to sell. Some mortgage companies can be of significant help. They do not want to add your home to their inventory of homes for sale.

You now have three well-defined marketing strategies from which to make a selection (the classic approach was discussed in an earlier article). A few additional considerations will be very helpful. But first, it bears repeating that if a home’s price is too high for the current market, there will be few visitors to it and no offers.

Even if your overpriced home is shown occasionally, it will receive no offers. Any buyer who sees 20 homes in a certain price range will be able to easily reject, as a comparatively poor value, any home that is priced 10% or more over its fair market value. Because many other homes are priced right, your home also needs to be priced correctly in order to compete. Worse yet, an overpriced home will be shown to the wrong group of buyers; those who can afford more. These buyers will buy a home of greater value in which to live, rather than accept your somewhat lesser home even if it might be obtained at a discount.

Sellers whose prices have too much "room for negotiating" invariably end up with no offers to negotiate. One study showed that that if a home is overpriced by 15% initially, time on the market can easily be 300 days. Although this data was developed in a slow market with stable prices, it serves to illustrate an axiom: The higher the price, the longer the time on the market! In addition, overpriced homes often must be reduced before they sell, so time and money are lost for no gain at all. To repeat, overpriced homes are not shown to the right group of buyers. They languish on the market because they are competing with the wrong set of homes: Those of greater value.

Here’s a compelling thought: If the average home’s selling price is, for example, 95% of its asking price, then the average home does not receive a viable offer until its asking price is within about 5% of its actual market value. This fact reinforces the critical importance of having only a small margin of "fat" in the asking price for leeway in negotiation.

No matter what strategy you employ or at what stage you find yourself, if a price reduction is needed, it usually should be greater than 5%. A reduction smaller than 5% is not significant to the market. It is a waste of time and effort to even imagine that it will make a difference. On the other hand, reductions greater than 10% generally should be avoided. There is a risk that an entire range of buyers could be bypassed completely, never learning of your good value. In any event, get the price right, and your home will sell.

Round Number Pricing

A little-known advantage will be gained by pricing your home exactly on a round number. You are not selling clothing, gasoline, groceries, or used cars. Remember that the home selling market is uniquely driven by online computer searches. By pricing on a round number you will get more visitors and sell faster. An example will help:

- Agent A has buyers looking in the $550,000 to $600,000 range.

- Agent B has buyers looking in the $575,000 to $625,000 range.

- Agent C has buyers looking in the $600,000 to $650,000 range.

If your home is priced on the round number $600,000, it will be considered for showing by all three agents above when they do an MLS computer search for available properties. If your home is priced at $599,999, only Agents A and B will find your home in their computer output. Agent C will be oblivious to the fact that your home is for sale.

Almost all agents, as well individual buyers, search in round numbers. In fact, many of the myriad third-party sites (e.g. Zillow, Trulia, etcetera, etcetera) provide online price pick-lists that do not allow anything other than round numbers.

Of course, not every home can be priced on an even $100,000 interval, but use increments of $10,000 or prices ending in $25,000 or $75,000. This pricing tactic will gain you a competitive edge over most sellers. "Over how many other sellers," you ask? Check some random prices of homes for sale to see how many sellers understand real estate market pricing as well as you now do.

Put Your Best Foot Forward

Preparing to market your home will take time and thought. The ideas presented here are those that are most important, frequently overlooked, or unique. Read on carefully, a home that shows poorly will cost its seller at least 10% to 15% of the home’s fair market value as well as require an extended marketing time, and cause needless aggravation.

First impressions are the strongest. In marketing your home, as in life, you never get a second chance to make a good first impression. So, when your prospective buyer pulls up to the curb, make it count. When visitors arrive, they will use all their senses, with the possible exception of taste, to gain an impression of your home. The following will form their impression:

- Obvious factors and qualities such as the carpet color or the number of bathrooms

- Recognizable and definable, but not obvious, factors such as proximity to a Metro station or the existence of a community pool and tennis courts

- Indefinable, subtle, and often unspoken feelings.

Your objective is to slip into the shoes of the home buyer, a total stranger, and identify the essential elements, whether positive or negative, dealing with each, bringing the positive ones into sharp focus and eliminating or minimizing the negative ones. It will be difficult for you to identify subtly embarrassing or possibly offensive elements of your home. The importance of eliminating these factors is easy to understand: Unspoken objections, can represent powerful negatives, and can never be known, addressed, or resolved by the agent showing your home. You must identify and eliminate such problems if at all possible.

Minor repairs should always be done. Fixing that dripping faucet, the hole in the wall, and the loose front doorknob are minor expenses that will return many times their cost, not to mention those closet doors that are off their tracks or dragging on the carpet. When buyers observe minor maintenance items that have not been done, they wonder what other problems might be lurking. Also, standard resale contracts require that major systems, appliances, et cetera, to be in normal working order on the date that possession is delivered. Why wait?

The presentation of your home that you are striving for can be summarized as: light and bright; uncluttered and neat; neutral in color and pattern; impersonal and inoffensive; and clean. Of course, an entire book could be written on preparing a home for the market, its importance, and what happened for those sellers who did it right, and to those sellers who did not. But for now, we will just hit the highlights. Bear in mind that home buyers will be especially impressed with your home if it is neutral, neat, and clean.

To achieve "light and bright," go through your home carefully and replace the light bulb in each lamp or lighting fixture with the maximum wattage bulb allowable. Permanently installed fixtures should have labels showing the maximum watts. No penny pinching either; if a lamp will take a three-way bulb, go first class. Wash the lenses of all lamps and lighting fixtures. Remove shades, blinds, drapes, and curtains if possible, but be careful not to create a barren look or expose ugly windows or unpleasant views. Sheer curtains that you feel are needed should be taken down, cleaned, and re-hung. Have all windows washed inside and out, including the space between the windows and storm windows, which sometimes resembles an insect cemetery.

The ideal home for showing has a minimum of furniture. Identify any items that you will not move to your next home and sell, donate, give, or throw these things away now. Remove furniture from hallways and narrow foyers. Move any furniture that impedes entry or clear sight into any room. Pack all valuables, collections, and family photographs and store them safely for the move. Remove everything from kitchen counters, bathroom vanities, and your desk top. Replace only those items that you are sure to need in the coming week. Pack the rest. Be honest, you will never use all of those 137 lipstick colors next week. Give some attention to storage spaces, attics, and garages as well, and remove everything from the stairs: A broken arm, leg, or neck is not the way you want a prospective buyer to remember your home. Keep your home neat at all times.

Neutralize colors and patterns as best you can without spending a fortune. Can you remove wallpaper and paint the walls? If you choose to paint, remove all the electrical switch plates and socket covers before painting and replace them with new ones as soon as the paint is dry.

The more impersonal your home, the less chance it will offend your buyer. Often buyers will not openly express their personal feelings about what they find offensive. Sometimes their feelings are not even put into words. But they rarely want to think of a home that they found distasteful, let alone see it again. Clean everywhere, but pay special attention to kitchens and bathrooms. Tile grouting and tub caulking must be cleaned and bleached white. If stains persist, consider replacing the offending material. For rust stains, look for products containing oxalic acid. Any soiled carpets must be cleaned if not replaced. Get professional help if necessary. If there is any question about your carpet, get an estimate for replacing it with modest quality, light, neutral carpet, the same in all rooms.

Try to find paint to touch up the appliances and the corners of walls where the paint has been chipped off. If your home has a forced-air HVAC system, clean the vents giving special attention to cold air returns. While you’re at it, replace the air filter.

Be alert to odors. The only time you will be able to evaluate odors is during the first few seconds after you return home. Track down any odors to their source and eliminate them. The cat’s litter box really needs changing more frequently than every month. Because your fireplace can produce unwanted odors, especially on rainy days, clean out the ashes and set new logs for your next fire. Use some type of "odor eaters" or air fresheners, but avoid strong scents. If your HVAC system is forced-air, consider setting the circulating fan to "on."

Set the dining room table for dinner including plates, silverware, water or wine glasses, coffee cups, place mats, and napkins for four. Finally, don’t overlook the outside. Everything should be neat and trimmed. Your lawn should look picture perfect, and any required painting should be done. This is the ideal time to remove the spare plumbing fixtures and the old car (the one up on cinder blocks) that you have been saving in the front yard. If your home does not look inviting from the curb, many buyers will drive by and never come in. Elementary? Intuitively obvious? But thousands have lost millions through their own disregard and negligence. Do not join them.

Home Preparation Checklist

(First impressions are the strongest.) The following summarizes the ideal presentation of your home:

- Light and bright

- Uncluttered and neat

- Neutral in color and pattern

- Impersonal and inoffensive

- Clean

Specifically:

- Replace the light bulbs in each lamp or fixture with the highest-wattage bulbs allowable

- Clean the bulbs and lenses of all lamps and fixtures

- Consider replacing incandescent bulbs with LEDs which are often brighter

- Have all windows washed inside and out

- Clean in between windows and storm windows

- Open blinds and raise shades to maximize natural light

- Consider removing existing drapes to brighten the home

- Sell, donate, give away, or throw away, items that you will not be moving to your next home

- Remove furniture from hallways and narrow foyers

- Move furniture that impedes entry or clear sight into any room

- Remove everything from kitchen counters, bathroom vanities, and your desktop, then replace only those items that you use regularly

- Remove everything from the stairs

- Clean everywhere, paying special attention to kitchens and bathrooms

- Clean tile grouting and tub caulking, and use bleach to remove any dark mold

- Clean or replace soiled carpets and remove any dents left by furniture

- Touch up chipped appliances and the corners of walls where paint has chipped off

- Clean heating/cooling vents giving special attention to cold air returns

- Trim shrubs and bushes, and be sure your lawn is picture-perfect

- Paint the exterior of your home if needed

- Clean the front door and paint it if needed; and ensure that all hardware is polished and operating flawlessly

- Paint the interior if needed, and replace electrical switch plates and socket plates with new ones

- Fix all dripping faucets

- Set the dining room table for dinner

- Write a personal letter to your prospective buyer.

MARKETING

[Return to Top]Planning Your Marketing Effort

In the absence of any written provisions to the contrary, anything that is attached or fastened to the property conveys (that is, it stays) with the property. Identify personal property that will be sold with the home such as that oversized, wall-mounted telephone that covers the spot where the wallpaper is missing. In our area, it is customary to sell the refrigerator along with the home. Also identify what property will not be conveyed. If you are not leaving Granny’s crystal and gold chandelier, replace it now and avoid silly "Does Not Convey" signs, which raise more questions than they answer. Besides, some buyers specialize in negotiating such heirloom items into the contract. It’s better if they are never seen.

From which direction will most of your buyers be coming? Select a suitable major intersection and prepare directions from there to your home via the easiest or, alternatively, the most scenic route. If possible, avoid having your buyers pass the local landfill, junkyard, or neighbors whose properties bear any resemblance thereto. A table of the minutes or miles to the following points will also help:

- The nearest supermarket

- The nearest large shopping mall

- The nearest Metro station and bus stop

- Recreation centers, lakes, parks

- Golf courses, tennis courts

- All major airports

- Major highways

- Downtown D.C.

Don’t doze off yet! The best is yet to come. Chances are that your agent has never lived in your home. Therefore, you are the one best able to identify its unique features that need amplification. Consider why you bought your home originally. Whatever sold you might be exactly what your buyer is looking for, so point it out. Was it curb appeal? Room sizes? Privacy? A view? Community amenities? Was it something really superb, that you have become so accustomed to, that you now take it for granted? Most importantly, is it something that might not be obvious to your buyer? Something simple but personal? Give the idea some thought and you will be duly rewarded.

An excellent vehicle by which to convey some important thoughts is a personal letter from you to your prospective buyer. The more personal, the better. It can be handwritten or typed, and it should be signed with your first name. Include it with the information handout available to visitors in your home.

If you have a major highway, a railroad, or high voltage power lines in your yard, give some thought to how these negatives can be minimized. If you have lived with such things, they probably did not bother you. Figure out why. You likely will have to convince your buyers that these features will not be a problem to them either.

Information on monthly homeowners’ association dues or condominium fees will be required. A tabulation of last year’s utility bills will help to answer the inevitable question. Do buyers really think that a few dollars a month, plus or minus, on utility bills will make or break a home purchase? Or do they think that bills from one homeowner can be relevant, despite the wide variation in personal heating and cooling preferences? In any event, you will be ready.

You might order any required condominium or property owners association disclosures so that they are available when your home goes on the market. Delivery of these can take up to two weeks. Keep them handy to pass on promptly to your purchaser. But if your time on the market is long, these disclosures could become out of date and some additional expense will be incurred to obtain an updated issue. Ask your agent to advise the best course of action in view current laws and the buyer’s right to rescind the contract.

Samples of the contract and addenda forms that will be used by your purchaser should be reviewed so that any questions can be resolved at this time. Your agent can provide copies of these standard forms. When a contract is presented, time will be of the essence and you will be able to respond in a timely manner.

Is your mortgage assumable by your purchaser? Most loans are not attractive when they are assumable and are not assumable when they are attractive. Nevertheless, any buyers who wish to assume your loan should be required to qualify for it on their own financial merits. During the process you must be sure that you are released from future liability to repay the loan. With VA (Veterans Administration) loans, you also need to consider the effect on your entitlement, whether you will be able to obtain another loan. Letting your buyer assume your loan is generally not recommended, and offers very few advantages, especially when interest rates are low.

Are you willing and able to provide owner financing? Be cautious in this area. Are you skilled at assessing your buyer’s financial condition and ability to repay? Are you prepared to foreclose if your buyer defaults? Why does the buyer need owner financing, which involves higher monthly payments because the interest rate is higher and the term is shorter? Will a mortgage lender provide the required funds? If the answer is "NO," then don’t put your money on the line either.

And finally, remember that your home is on the market, especially if you are one who would find it somewhat awkward to meet your prospective purchaser while taking your bubble bath. Most showing agents will give you ample warning.

Critical Information

When you are selling your home, the most valuable exposure is through the MLS database. It’s 50 times as important as whatever is in second place. Serious home buyers do not want to waste time. They know how to find a home: Get an agent to show them MLS-listed homes. It is a lot quicker than attending open houses or chasing real estate signs. That is why well over 90% of all homes are sold this way.

No, your listing agent will not personally find your buyer. This means that the information entered into the MLS computer is critical to your success! Your listing agent is your connection to the buyer and computer literacy is one of the most important factors in putting your home’s best foot forward.